Tax Withheld Meaning In Tamil Jan 20 2025 nbsp 0183 32 The top marginal rate of tax for resident individuals is 30 see tax table below Non resident individuals are subject to tax at a flat rate of 15 on employment income which

Value Added Tax is a consumption tax charged by VAT registered traders on all taxable goods and services at a standard rate of 18 The VAT is a multistage tax levied at each stage of To hear and determine tax appeals arising from the decision of the Tax Revenue Appeals Board as provided for by Section 11 of the Tax Revenue Appeals Act Cap 408 R E 2009

Tax Withheld Meaning In Tamil

Tax Withheld Meaning In Tamil

https://i.ytimg.com/vi/h0mjxR5t4TQ/maxresdefault.jpg

Withholding Tax Filing And Payment Of Withholding Tax YouTube

https://i.ytimg.com/vi/ial0EX5C7cs/maxresdefault.jpg

Withholding Taxes How To Calculate Payroll Withholding Tax Using The

https://i.ytimg.com/vi/VkmlfgHvlHU/maxresdefault.jpg

These user friendly tools are designed to help individuals and businesses in Tanzania quickly estimate income tax liabilities for various tax years and view the associated effective tax rate This report comprised both tax and non tax revenue sourced from respective institutions It also presents tax rate by type individual and company income tax and tax to Gross Domestic

Aug 22 2025 nbsp 0183 32 This tax datacard provides an overview of the main taxes applicable in Tanzania including tax rates tax depreciation rates filing obligations and the basis for interest and May 16 2025 nbsp 0183 32 A guide to the tax system in Tanzania outlining laws tax rates tax incentives transfer pricing international taxation tax treaties and VAT

More picture related to Tax Withheld Meaning In Tamil

W4 Tax Withholding Steps 2 To 4 Explained 2024 Money Instructor

https://i.ytimg.com/vi/Prh1H0uaC88/maxresdefault.jpg

W 2right Saving For Retirement Retirement Planning Federal Retirement

https://i.pinimg.com/originals/05/fe/c8/05fec8bce62b72d5ca7dc5778f0562b3.png

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

UNDEFEATED Nike 52 OFF

https://www.investopedia.com/thmb/ke0KhYqewY_QD0xGnDslnrieYRo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg

Income tax is the major direct tax in the country comprising individual personal income tax and corporate income tax This law also provides for Withholding Tax WHT and Capital Gains Tax It is a security mark or label placed on excisable products to confirm that tax has been paid and the product has passed through the proper supply chain to protect consumer s health by

[desc-10] [desc-11]

Taxes For Filipino Freelancers and How To Compute Them 54 OFF

https://desk.zoho.com/DocsDisplay?zgId=56875427&mode=inline&blockId=aij0o53abc3cf472b4fb5b3faf213cb7fb886

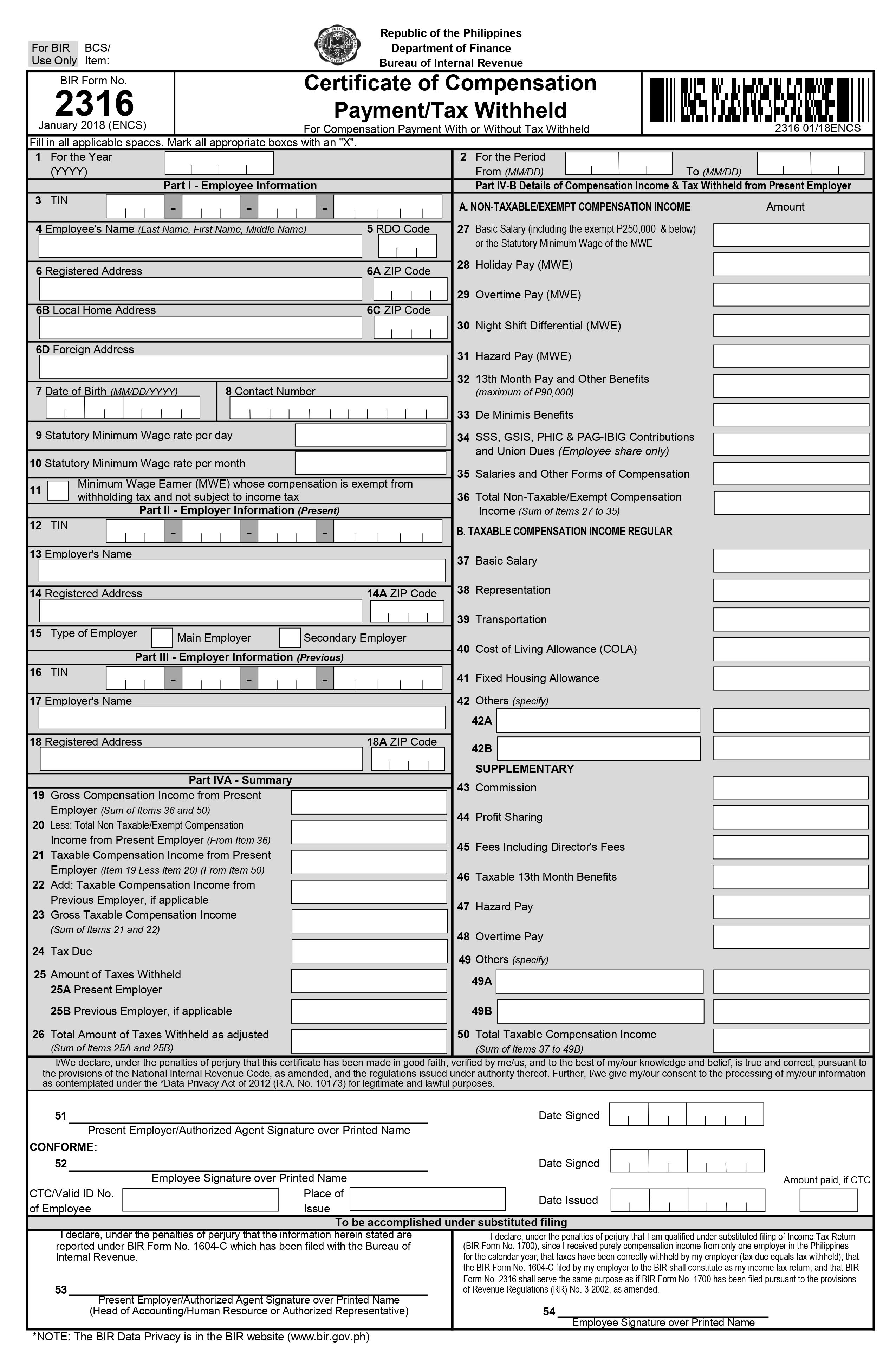

Form 2316

https://juan.tax/wp-content/uploads/2018/02/BIR-Form-2316.jpg

Tax Withheld Meaning In Tamil - This report comprised both tax and non tax revenue sourced from respective institutions It also presents tax rate by type individual and company income tax and tax to Gross Domestic