Tax Slab In Old Regime For Fy 2024 25 Pdf While sub Saharan African SSA countries have made some progress in collecting more taxes domestically in the last 20 years international tax issues remain a significant concern for these

6 days ago nbsp 0183 32 Non residents are liable to Ghanaian income tax on any income derived in Ghana from any trade business profession or vocation or which is derived from an employment Dec 13 2021 nbsp 0183 32 This article aims to shed light on the tax system in Ghana by explaining the role of the Ghana Revenue Authority GRA in the country s tax regime as well as the various taxes

Tax Slab In Old Regime For Fy 2024 25 Pdf

Tax Slab In Old Regime For Fy 2024 25 Pdf

https://i.ytimg.com/vi/UDP7Wa_UkB0/maxresdefault.jpg

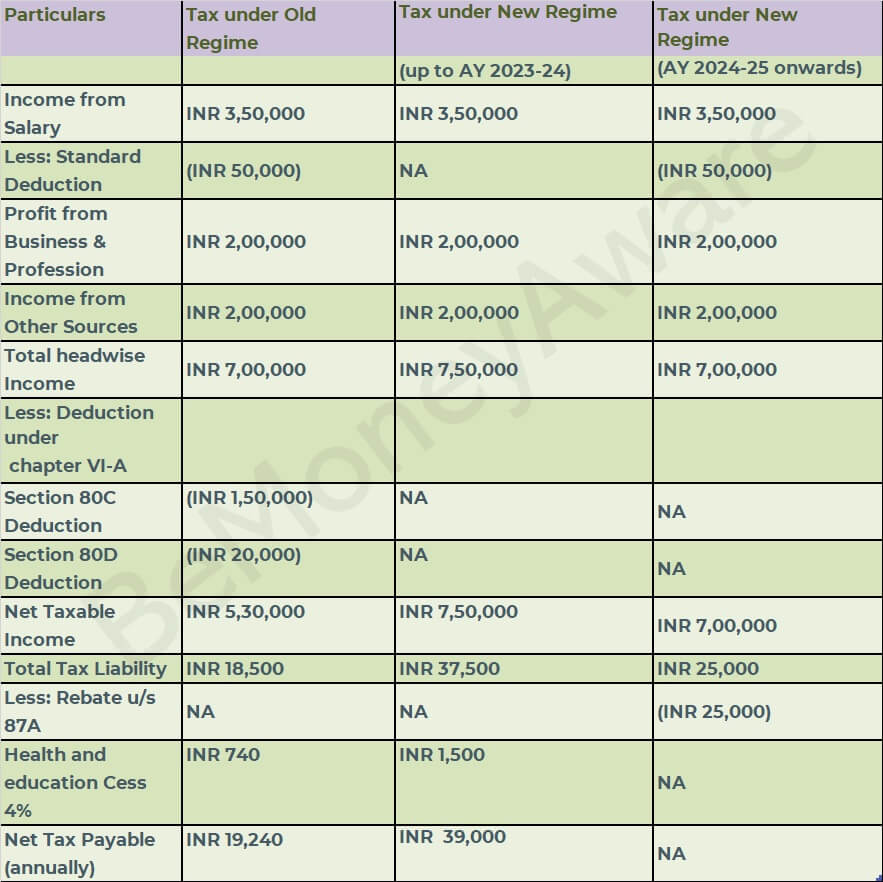

Income Tax Slab Rates FY 2023 24 Tax Calculation With Old Vs New Tax

https://i.ytimg.com/vi/_UfZ_-uepv8/maxresdefault.jpg

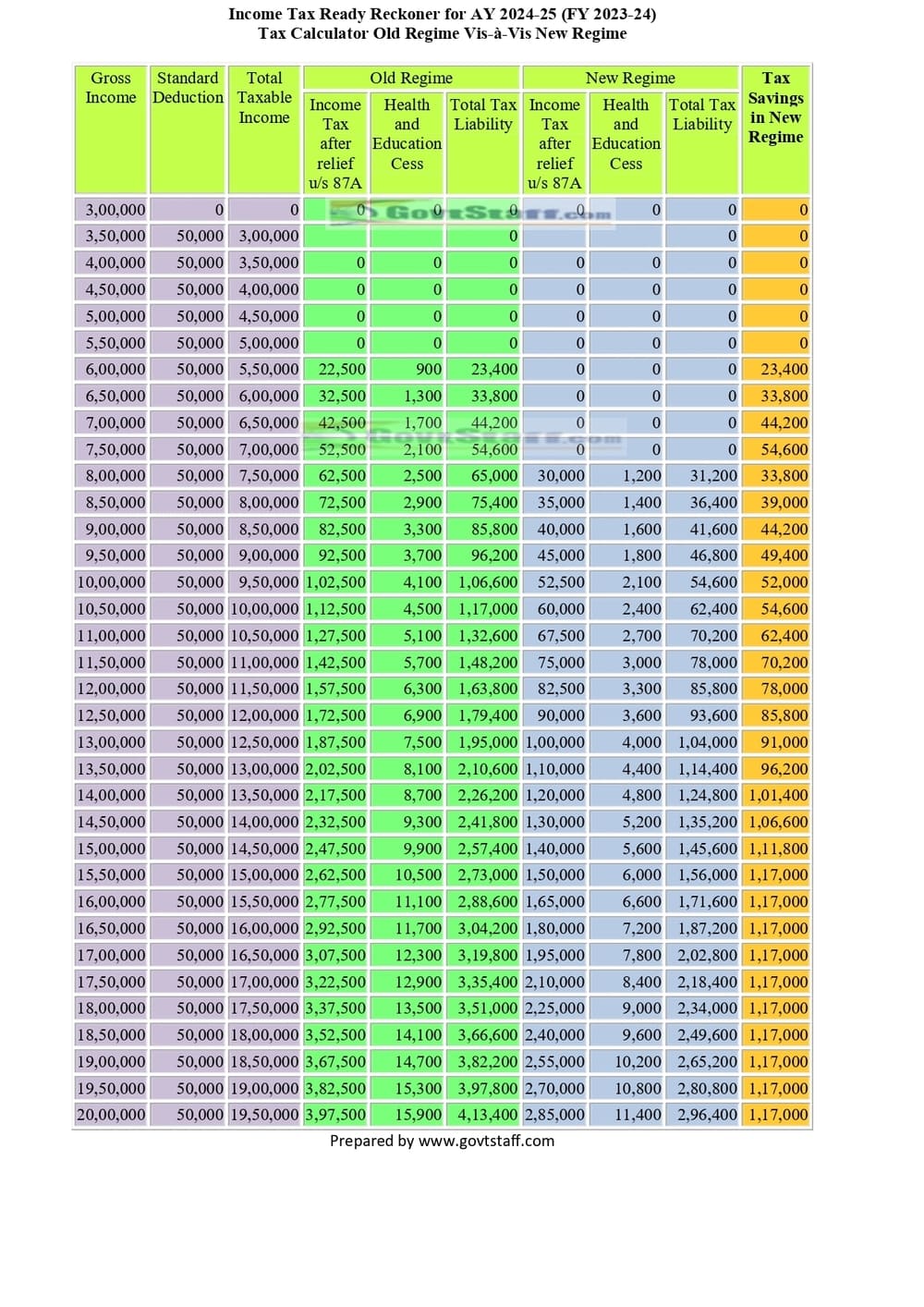

Income Tax Ready Reckoner For AY 2024 25 FY 2023 24 Tax 54 OFF

https://bemoneyaware.com/wp-content/uploads/2020/07/tax-calculation-old-new-tax-regime.jpg

This section highlights recent developments in Ghana s tax system focusing on key tax policy reforms and long term trends in revenues generated from different tax instruments Income tax is the principal direct tax charged on the income or profit of taxpayers Resident persons are taxed on their worldwide income while non resident persons are taxed on income

A person is liable to pay income tax on their chargeable income or on final withholding payment received during the year of assessment Income tax is payable by applying the relevant rates KPMG s individual income tax rates table provides a view of individual income tax rates around the world

More picture related to Tax Slab In Old Regime For Fy 2024 25 Pdf

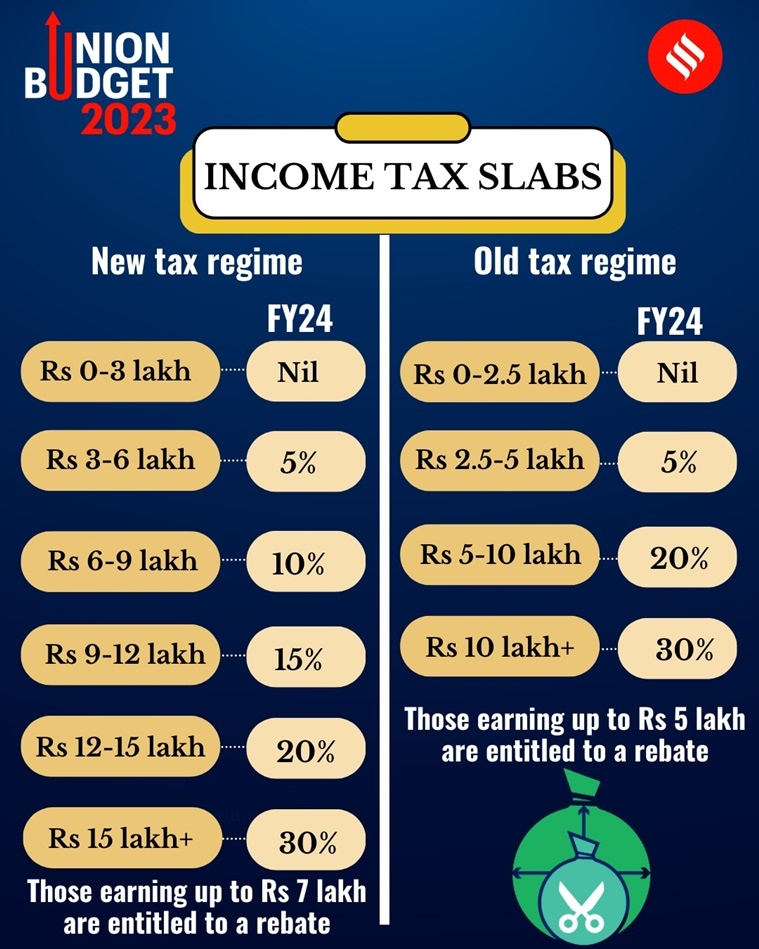

2024 Tax Slab India Cecil Daphene

https://images.indianexpress.com/2023/02/tax-slabs-759.jpg

Tax Calculator 2024 25 Excel Patsy Anne Marie

https://www.govtstaff.com/wp-content/uploads/2023/02/income-tax-ready-reckoner-for-ay-2024-25-fy-2023-24-tax-calculator-old-regime-vis-a-vis-new-regime.jpg

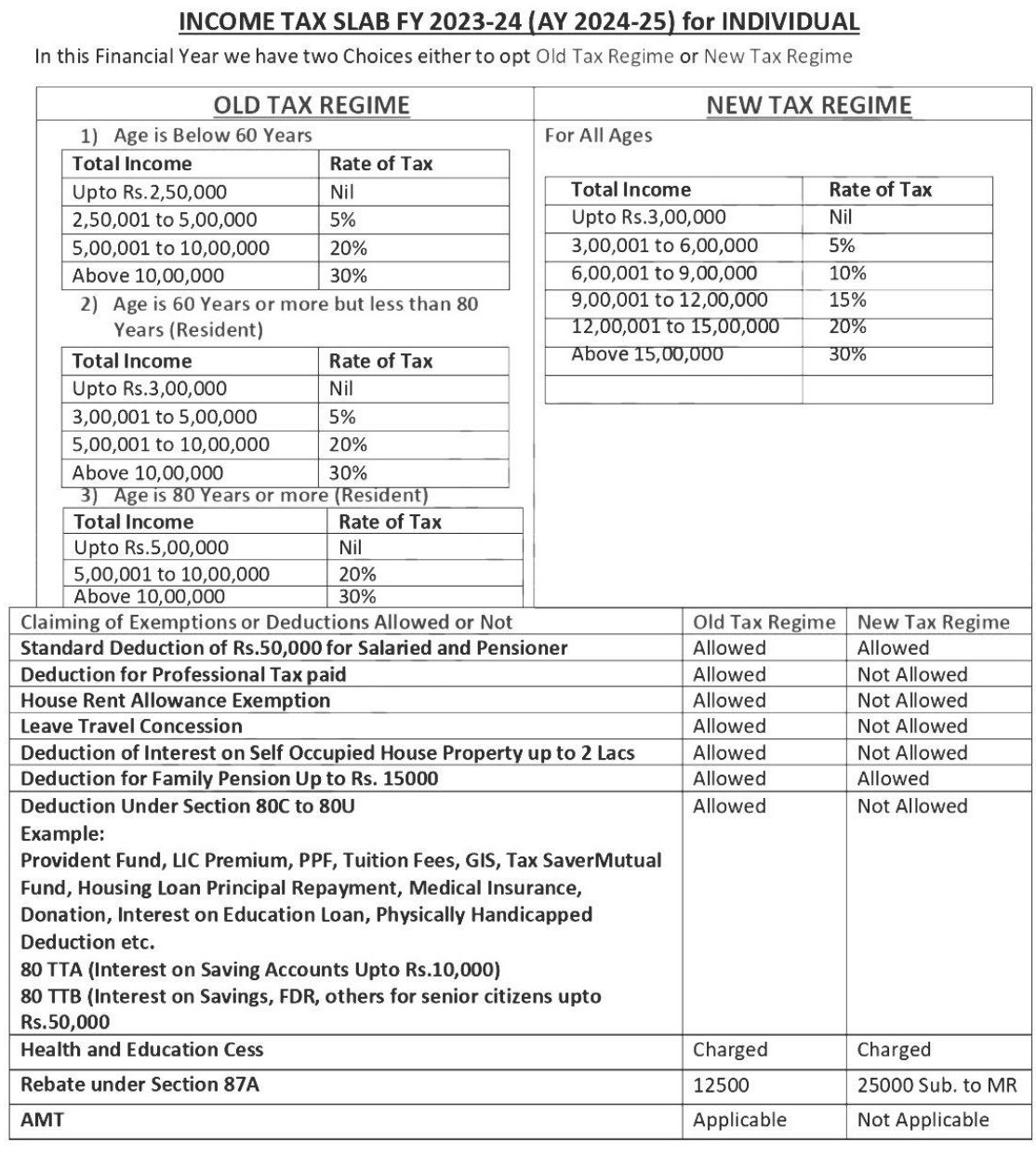

2024 25 Income Tax Slab Barbi Carlota

https://fincalc-blog.in/wp-content/uploads/2024/02/Income-Tax-Slab-Rates-2024-25.webp

Oct 9 2020 nbsp 0183 32 The 2025 edition of our Tax Facts and Figures publication provides an overview of the direct and indirect tax regime of Ghana and reflects significant amendments to the tax laws VAT on Imports and Exports VAT Exemptions Corporate Income Tax CIT Withholding Tax WHT Rent Tax Communications Service Tax CST Excise Tax Stamp

[desc-10] [desc-11]

Income Tax Slab For Fy 2024 24 Nomi Tessie

https://carajput.com/blog/wp-content/uploads/2023/12/INCOME-TAX-SLAB-FY-2023-24-AY-2024-25-for-INDIVIDUAL.jpg

Tds New Slab Rate For Fy 2024 25 Tate Zuzana

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-india-2022-23.webp

Tax Slab In Old Regime For Fy 2024 25 Pdf - A person is liable to pay income tax on their chargeable income or on final withholding payment received during the year of assessment Income tax is payable by applying the relevant rates