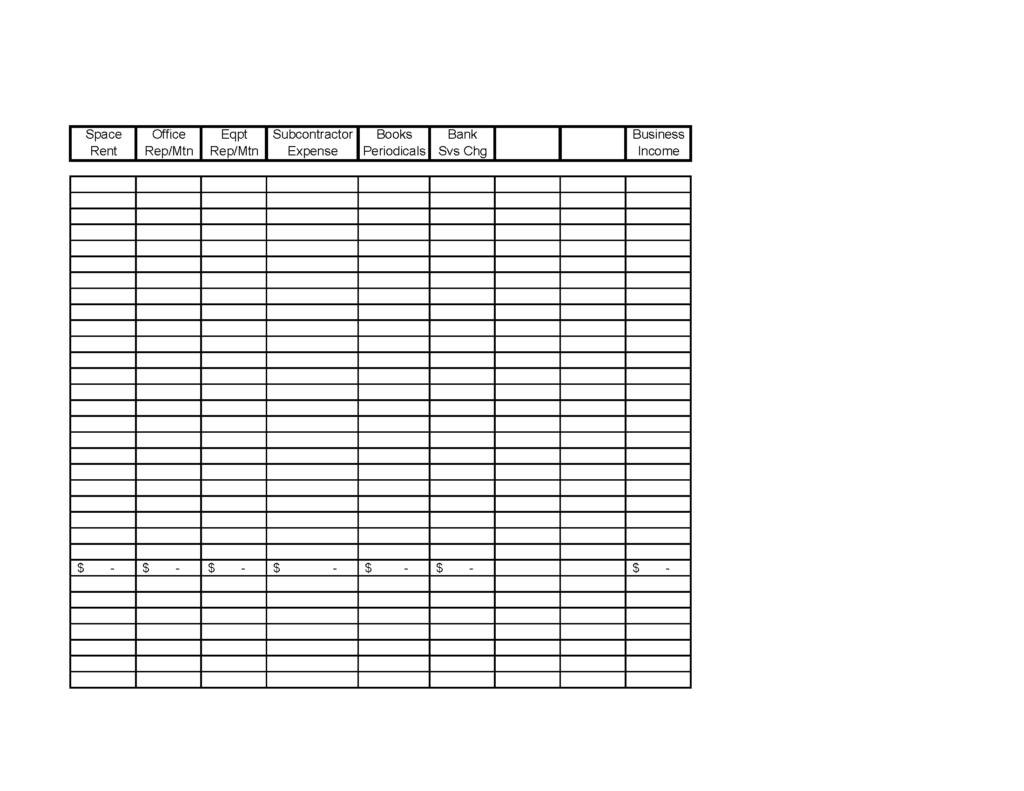

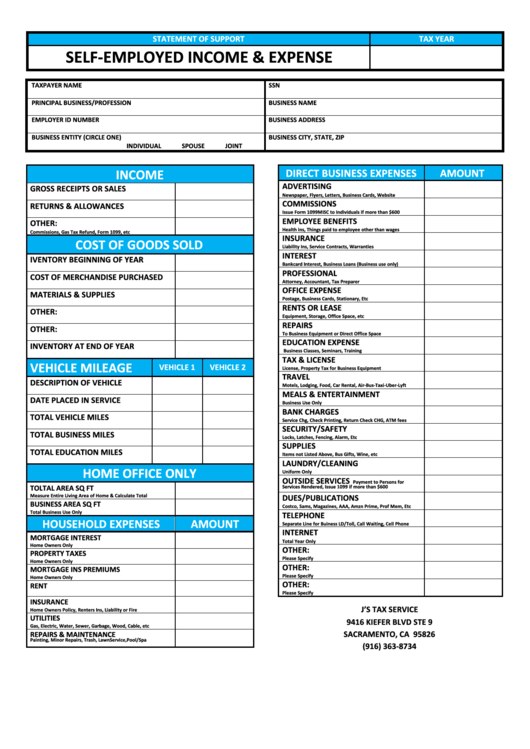

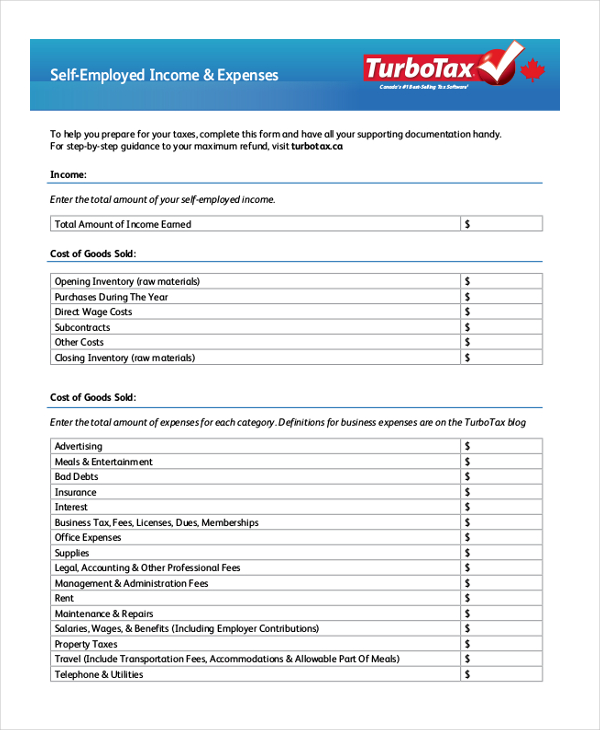

Self Employed Business Expenses Worksheet Schedule C Self Employed Business Expenses Worksheet for Single member LLC and sole proprietors Use separate sheet for each business Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income Total

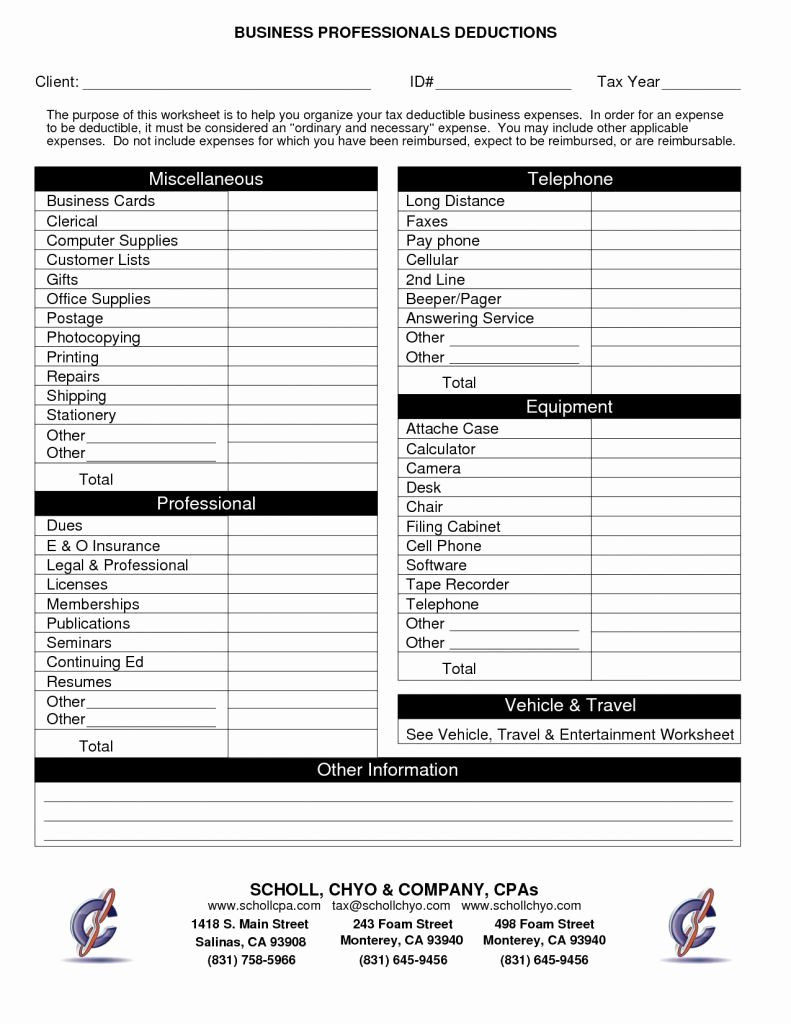

Publication 15 Circular E Employer s Tax Guide Publication 15 A Employer s Supplemental Tax Guide PDF Publication 225 Farmer s Tax Guide Publication 334 Tax Guide for Small Business For Individuals Who Use Schedule C Publication 463 Travel Gift and Car Expenses Publication 505 Tax Withholding and Estimated Tax Also use Schedule C to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain amounts shown on a Form 1099 such as Form 1099 MISC Form 1099 NEC and Form 1099 K See the instructions on your Form 1099 for more information about what to report on Schedule C

Self Employed Business Expenses Worksheet

Self Employed Business Expenses Worksheet

https://db-excel.com/wp-content/uploads/2019/01/self-employed-expense-spreadsheet-with-regard-to-schedule-c-expenses-spreadsheet-and-printables-self-employment-in-e.png

Self Employed Business Expenses Worksheet Business Spreadshee Self

http://db-excel.com/wp-content/uploads/2018/11/self-employed-expense-sheet-self-employed-expenses-spreadsheet-for-self-employed-business-expenses-worksheet.jpg

Self Employed Business Expenses Worksheet Business Spreadshee Self

http://db-excel.com/wp-content/uploads/2018/11/self-employed-expenses-spreadsheet-unique-personal-expenses-with-self-employed-business-expenses-worksheet.jpg

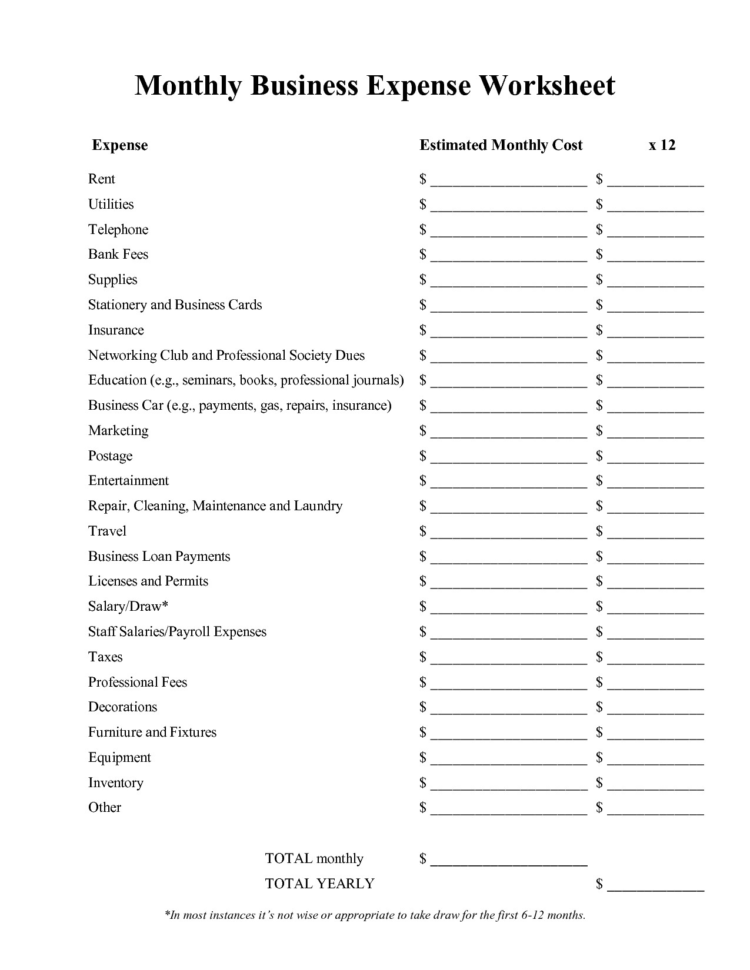

Use this monthly small business income statement template to track and manage your small business finances Enter the number of customers and the average sale per customer to determine your total monthly sales Then enter your operating payroll and office expenses to determine your total expenses The template will automatically calculate This printable small business expense report template offers an easy way to track company expenses Use the existing category names or enter your own column headings to best track business expenses Use this spreadsheet to track payments itemize expenses and more Once you enter the amounts the template automatically calculates total

Form your income projections and write those down outside of your budget template Put this paper or spreadsheet away until after you have completed the next step Enter your expenses into your Self Employed Business Expenses Schedule C Worksheet for unincorporated businesses or farms Use separate sheet for each type of business Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income Total

More picture related to Self Employed Business Expenses Worksheet

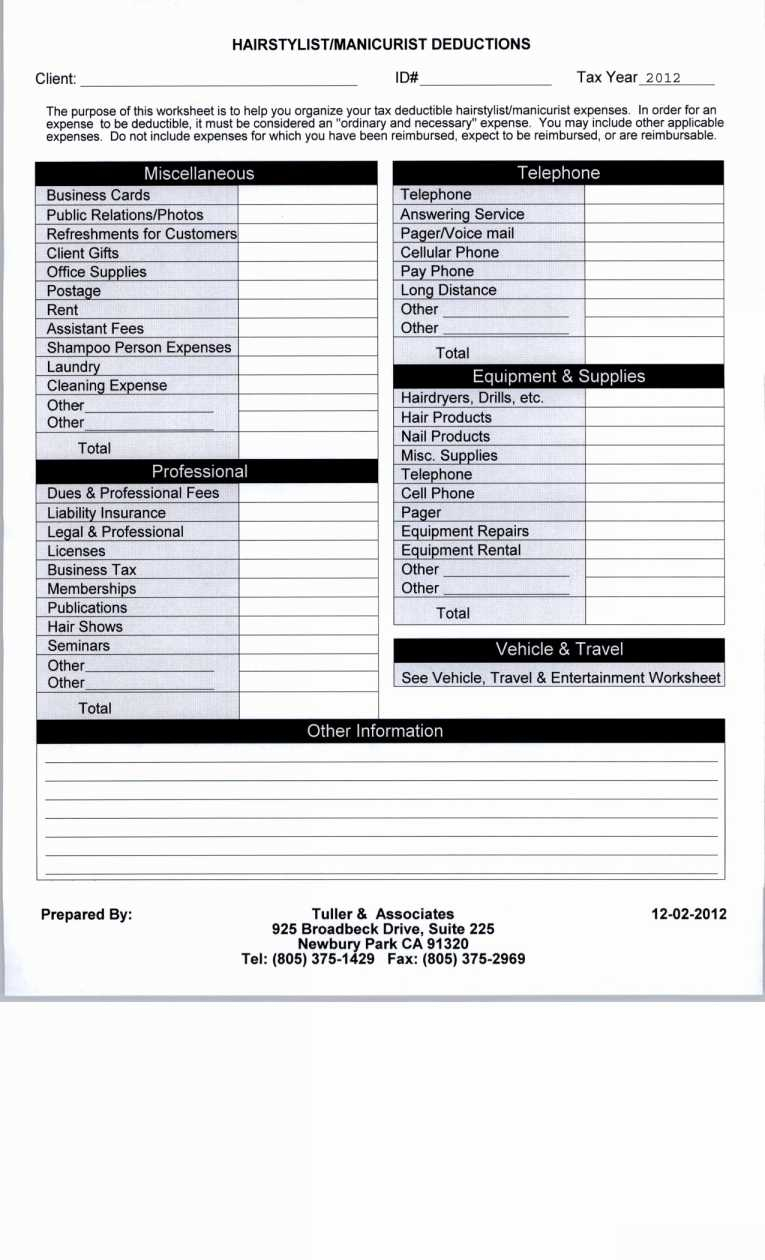

Self Employed Income Expense Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/304/3040/304072/page_1_thumb_big.png

Self Employed Health Insurance Deduction Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/self-employed-health-insurance-deduction-worksheet-2.jpg

FREE 11 Sample Self Employment Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/09/Self-Employment-Expenses-Form.jpg

Schedule C Worksheet for Self Employed Businesses and or Independent Contractors IRS requires we have on file your own information to support all Schedule C s Business Name if any Address if any Is this your first year in business Yes For 2023 the rate is 65 5 cents per mile The rate increases to 67 cents per miles for 2024 2 Depreciation and Section 179 expense deduction The law allows businesses to depreciate or gradually deduct the cost of assets such as equipment fixtures furniture etc that will last more than one year

Keep track of business expenses with this simple spreadsheet template Columns include Payment Date Method Description and Amount If you re self employed include home office expenses and other deductibles to help save time during tax season The template keeps a running subtotal of expenses adjusting the total sum with each new entry Self employed professionals face unique challenges when tax season comes around But because they don t have taxes withheld from their paychecks like traditional workers they can use deductions to cover their expenses and lower their tax burden But when it comes to self employed deductions the process certainly isn t one size fits all

12 Month Business Budget Template Excel Business Spreadshee 12 Month

http://db-excel.com/wp-content/uploads/2018/11/business-budget-template-excel-free-simple-monthly-bud-spreadsheet-within-12-month-business-budget-template-excel-750x970.png

Self Employed Business Expenses Worksheet Business Spreadshee Self

http://db-excel.com/wp-content/uploads/2018/11/self-employed-expenses-spreadsheet-inspiration-of-annual-business-intended-for-self-employed-business-expenses-worksheet.jpg

Self Employed Business Expenses Worksheet - This printable small business expense report template offers an easy way to track company expenses Use the existing category names or enter your own column headings to best track business expenses Use this spreadsheet to track payments itemize expenses and more Once you enter the amounts the template automatically calculates total