Schedule C Office Expense Instructions Dec 16 2024 nbsp 0183 32 Anyone earning income outside of a W 2 such as freelancers gig workers and sole proprietors needs to fill out this form The guide provides step by step instructions on completing Schedule C including how to report income expenses and calculate net profit

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file Jan 23 2023 nbsp 0183 32 To complete Schedule C for your small business taxes you ll need your business income costs of goods sold and more Attach Schedule C to your Form 1040 tax return

Schedule C Office Expense Instructions

Schedule C Office Expense Instructions

https://investors.wiki/en/covers/homeofficeexpense.jpeg

![]()

Real Estate Expense Tracker Enluli

https://db-excel.com/wp-content/uploads/2018/11/realtor-expense-tracking-spreadsheet-luxury-real-estate-agent-throughout-realtor-expense-tracking-spreadsheet-768x994.jpg

Schedule C 2024 Herta Giralda

https://www.printableform.net/wp-content/uploads/2021/06/schedule-c-instructions-with-faqs.png

Jan 6 2025 nbsp 0183 32 If you re a sole proprietor you ll probably report your income on IRS Schedule C when filing your tax return Here s how Since these expenses are an ordinary and necessary part of operating your business they are deductible on your Schedule C and should not be overlooked when you prepare your taxes

We show you how to complete and file your Schedule C form 1040 using simple step by step instructions The Schedule C is an IRS form that most self employed DTC sellers must Oct 17 2024 nbsp 0183 32 By completing a Schedule C individuals can claim various business expenses such as office supplies and advertising costs This will ultimately reduce your taxable income and ensure compliance with IRS regulations

More picture related to Schedule C Office Expense Instructions

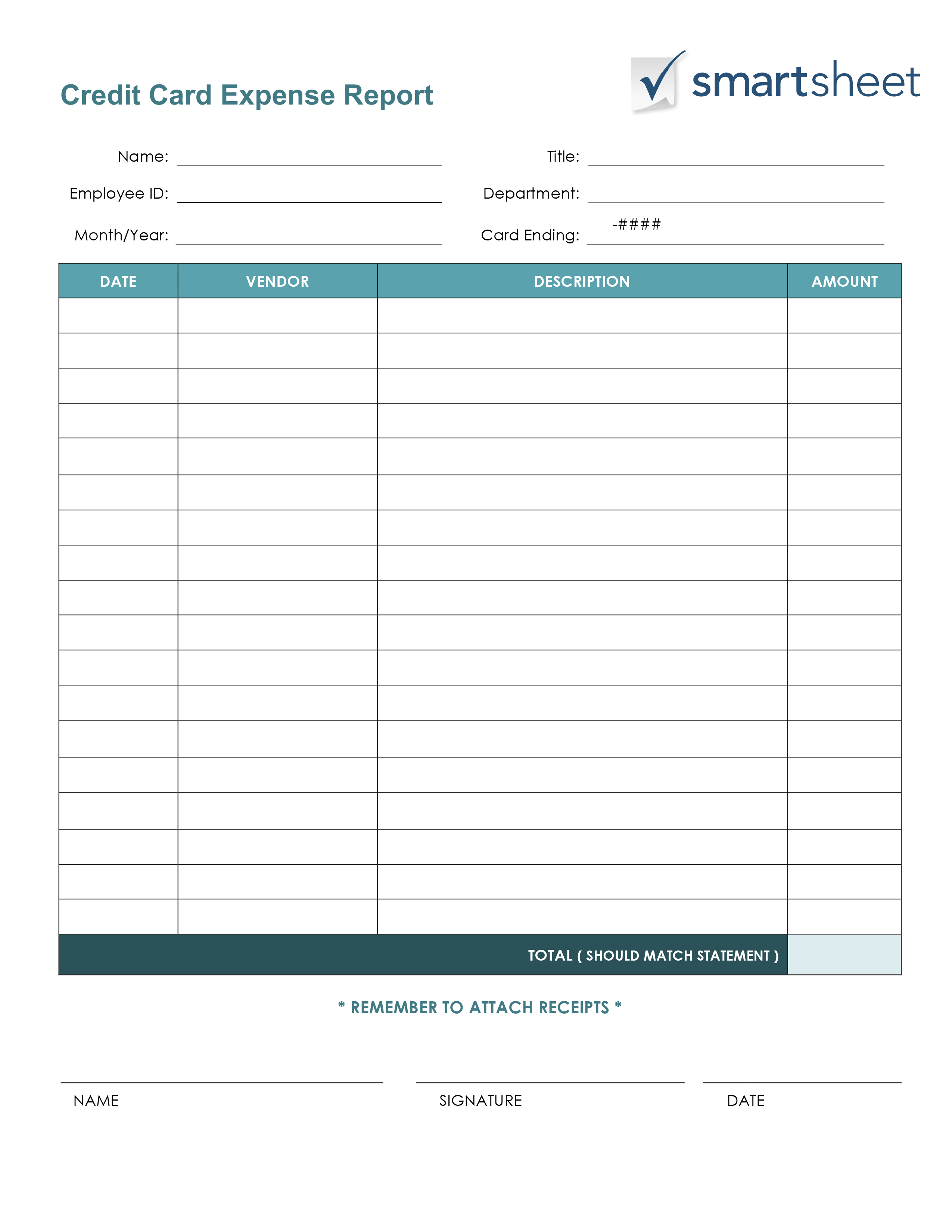

Schedule C Expense Excel Template Printable Schedule Template

https://www.printablescheduletemplate.com/wp-content/uploads/2018/05/schedule-c-expense-excel-template-schedule-c-expense-excel-template-SpvgmH.jpg

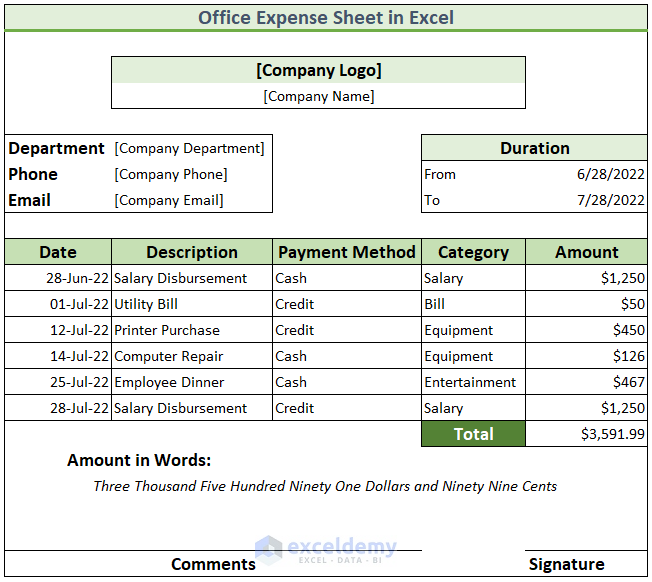

How To Make Office Expense Sheet In Excel with Easy Steps

https://www.exceldemy.com/wp-content/uploads/2022/06/How-to-Make-Office-Expense-Sheet-in-Excel-19.png

Home Office Deduction Worksheet Excel Printable Word Searches

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png

Jan 3 2025 nbsp 0183 32 Learn how to fill out Schedule C with step by step instructions along with a complete Schedule C example IRS Schedule C also known as Profit or Loss from Business is a tax form used to report the income expenses and overall profitability of a sole proprietorship or single member LLC

1 day ago nbsp 0183 32 I used the office and vehicle deduction every year as well as other expenses Gross income for 2024 was only 7300 and I have the child tax credit that eats up all of the refund if I deduct all of the business expenses My question is do i Also use Schedule C to report a wages and expenses you had as a statutory em ployee b income and deductions of certain qualified joint ventures and c certain amounts shown on a Form 1099 such as Form 1099 MISC Form 1099 NEC and Form 1099 K

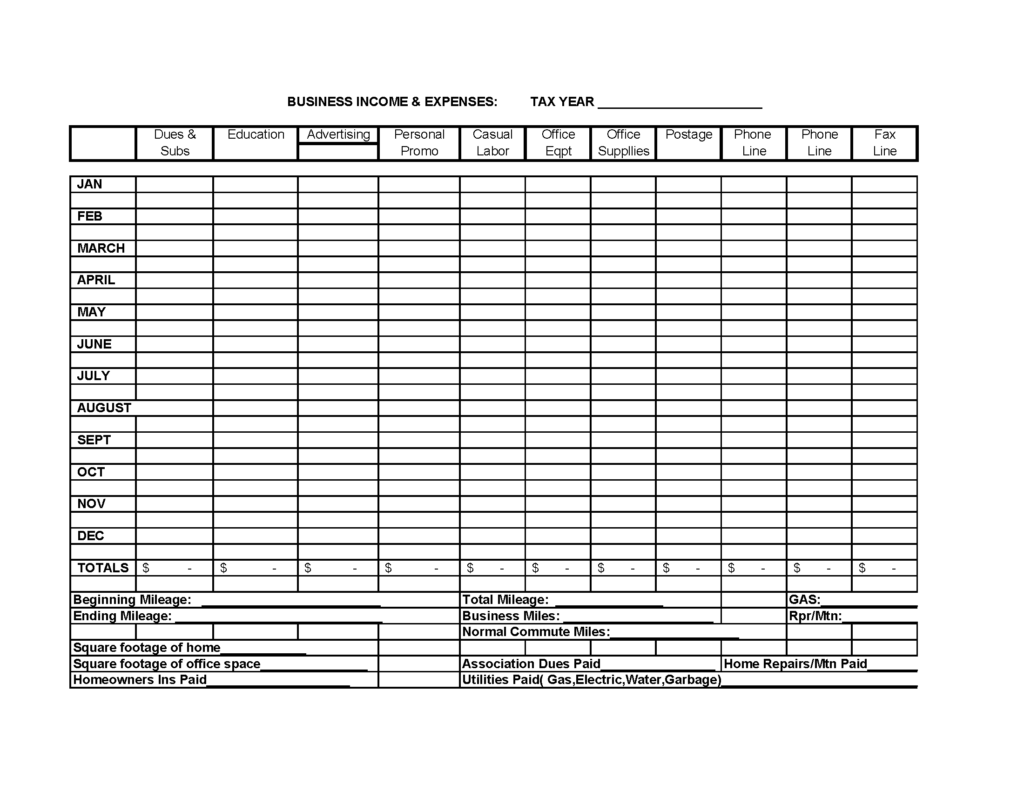

Home Office Expense Spreadsheet Excelguider

https://excelguider.com/wp-content/uploads/2019/07/business-income-expense-spreadsheet-template-business-budget-throughout-home-office-expense-spreadsheet-1024x791.png

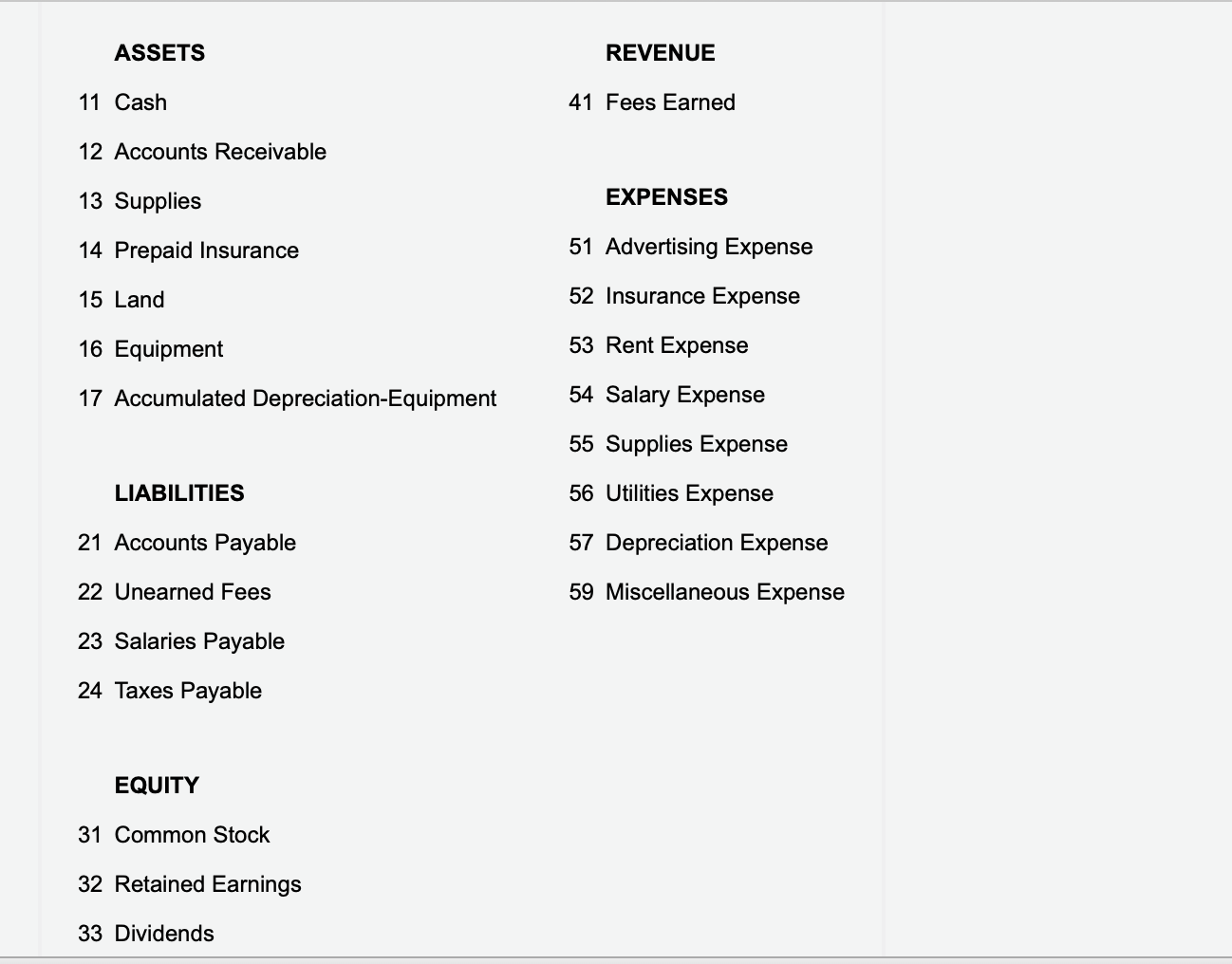

Solved Adjustment For Prepaid Expense Instructions Chart Of Chegg

https://media.cheggcdn.com/media/f5c/f5c54242-2275-4d9d-87ef-0992f5ccf2a6/phpwqau74.png

Schedule C Office Expense Instructions - We show you how to complete and file your Schedule C form 1040 using simple step by step instructions The Schedule C is an IRS form that most self employed DTC sellers must