Is Superannuation Contribution Taxable Jun 10 2022 nbsp 0183 32 A basic guide about what superannuation is how to save it and what you can do to grow it

May 29 2025 nbsp 0183 32 Superannuation or a company pension plan is a retirement benefit plan provided by a company Employers and employees contribute a fixed percentage of basic salary into a Superannuation or super is a compulsory system of placing a minimum percentage of your income into a fund to support your financial needs in retirement Your super is invested in a

Is Superannuation Contribution Taxable

Is Superannuation Contribution Taxable

https://nationalpensionhelpline.ie/wp-content/uploads/2023/01/superannuation.jpeg

Quick Superannuation Demo FoundU

https://www.foundu.com.au/hs-fs/hubfs/0524_NewWebsite_Demo_Thumbnails_9.png?width=6000&name=0524_NewWebsite_Demo_Thumbnails_9.png

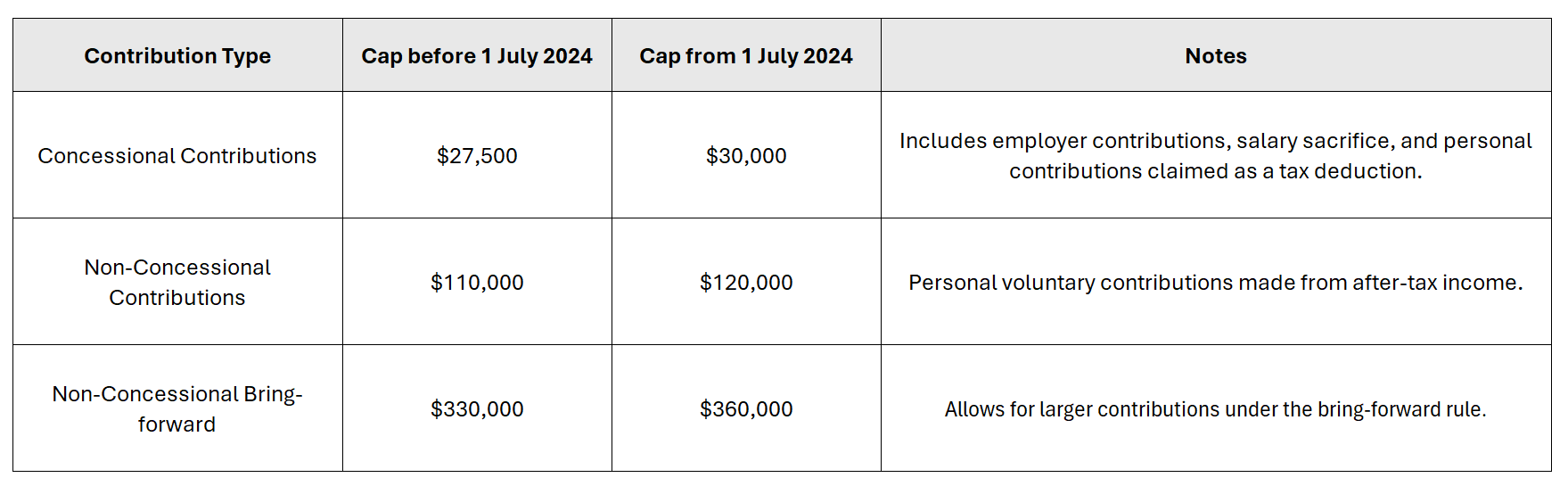

Superannuation Contribution Caps MKG Partners

https://www.mkgpartners.com.au/wp-content/uploads/2024/03/Superannuation-Contribution-Caps-Changes-1.png

What is a Superannuation fund This article provides in depth information about the superannuation fund its types benefits and calculation process Nov 26 2024 nbsp 0183 32 Superannuation is a form of pension scheme that an employer may provide voluntarily The employer periodically pays into the fund which is invested to generate a

Jan 14 2025 nbsp 0183 32 Superannuation often referred to as quot super quot is a compulsory pension program in Australia It involves employers contributing a percentage of an employee s earnings into a Sep 8 2024 nbsp 0183 32 Superannuation is a form of retirement savings which employees ensure through compulsory contributions to a trust or pension fund throughout their working lives

More picture related to Is Superannuation Contribution Taxable

National Core Accounting Publications Ppt Download

https://slideplayer.com/slide/13030795/79/images/8/Illustration:+Personal+Superannuation+Contribution+Limit.jpg

Prepare Tax Documentation For Individuals Ppt Download

https://slideplayer.com/slide/13361169/80/images/7/©+National+Core+Accounting+Publications.jpg

Joe Flaherty Enda And Julie

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1089211649881817

Apr 4 2025 nbsp 0183 32 Superannuation refers to a system or arrangement designed to provide individuals with financial support or income during their retirement years In many countries it involves May 16 2025 nbsp 0183 32 Superannuation refers to the retirement benefit plan where employers contribute to a fund for employees ensuring financial security post retirement

[desc-10] [desc-11]

Generation Y Super Smart Ppt Download

https://slideplayer.com/slide/14375984/89/images/5/Salary+sacrificing+to+boost+your+super.jpg

401k 2025 Elizabeth W Bryant

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

Is Superannuation Contribution Taxable - Jan 14 2025 nbsp 0183 32 Superannuation often referred to as quot super quot is a compulsory pension program in Australia It involves employers contributing a percentage of an employee s earnings into a