Irs Car And Truck Expenses Worksheet Instructions In order to claim a deduction for business use of a car or truck a taxpayer must have ordinary and necessary costs related to one or more of the following Traveling from one work location to

When claiming car and truck expenses the IRS allows taxpayers to use either the standard mileage rate or actual expenses When can the standard mileage rate be used Jun 4 2019 nbsp 0183 32 If you use your vehicle for both business and personal purposes we ll calculate actual expenses by applying the business percentage we determined from the mileage

Irs Car And Truck Expenses Worksheet Instructions

Irs Car And Truck Expenses Worksheet Instructions

https://i.pinimg.com/originals/ed/37/23/ed372359aac4e974a39e6494da5610e6.jpg

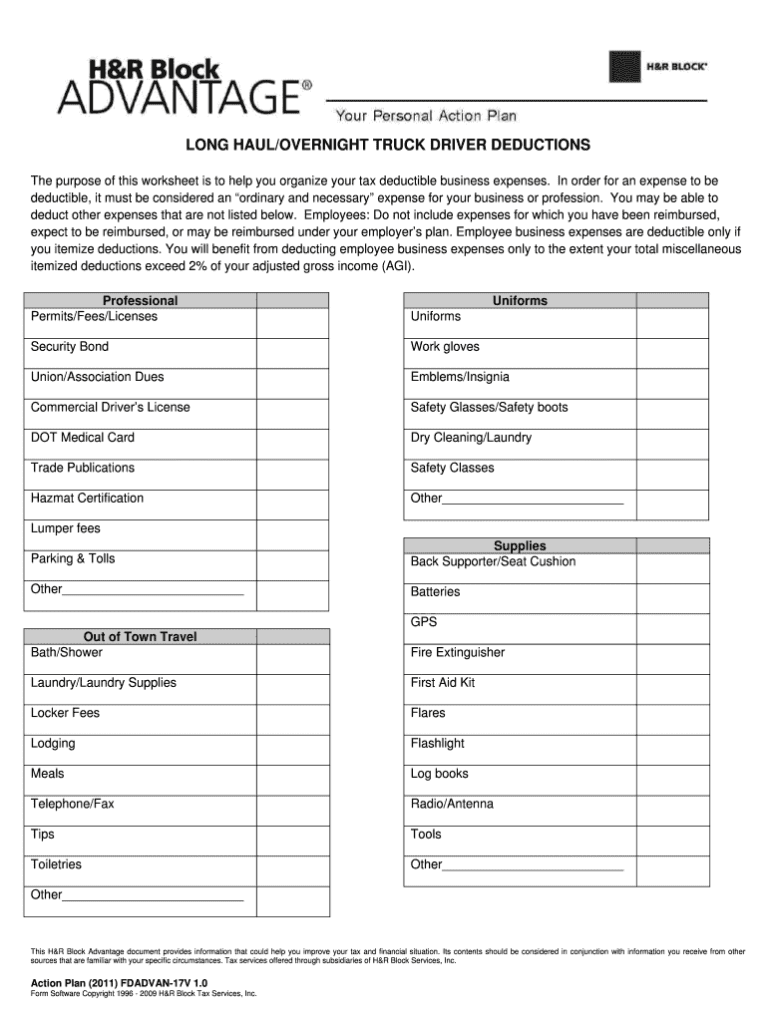

20 Car And Truck Expenses Worksheet Worksheets Decoomo

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/truck-driver-expense-spreadsheet-schedule-c-car-and-expenses-750x970.jpg

Truck Driver Expense Blank Forms Fill Online Printable Db excel

https://db-excel.com/wp-content/uploads/2019/09/truck-driver-expense-blank-forms-fill-online-printable-2-768x1021.png

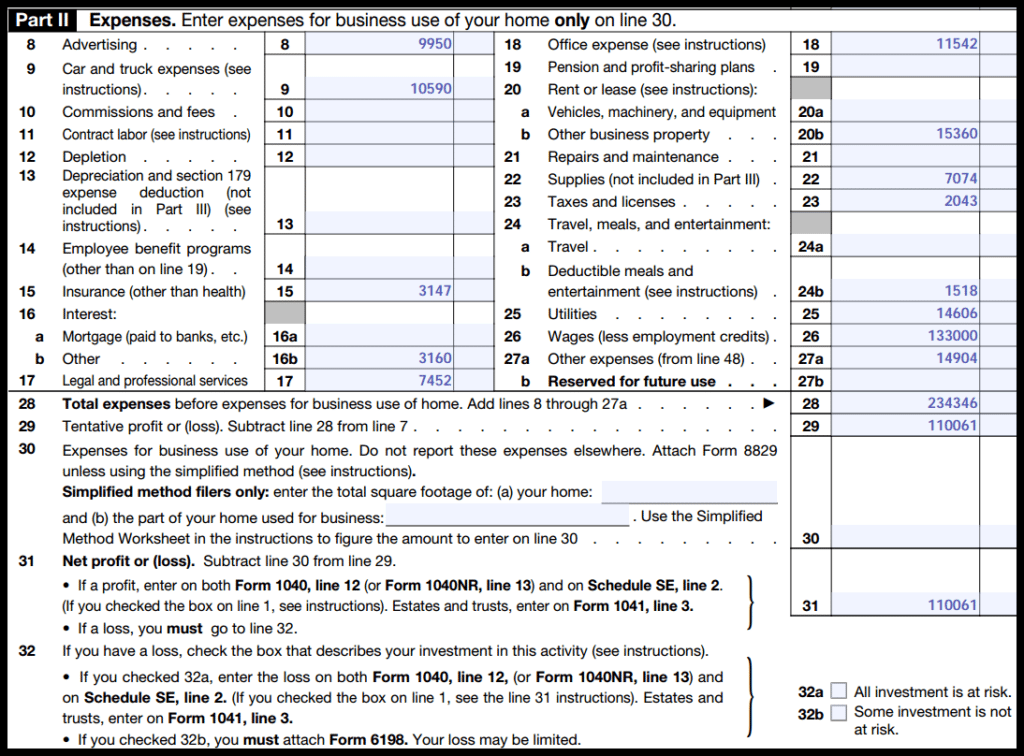

To determine the amount of car and truck expenses that can be included in actual expenses or the total business expenses reported on Schedule C Schedule C EZ Schedule E or Schedule F you must use one of the following two methods Use Tax Form 1040 Schedule C Profit or Loss From Business as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return Gross receipts or sales

Car and Truck Expenses Worksheet Complete for all vehicles 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage Jan 24 2023 nbsp 0183 32 Car amp Truck Expenses Worksheet You should only be asked information regarding your business auto use if you indicated in the program that you use your auto for business

More picture related to Irs Car And Truck Expenses Worksheet Instructions

Schedule C Car And Truck Expenses Worksheet Luxury Tax Expense For

https://db-excel.com/wp-content/uploads/2018/11/schedule-c-car-and-truck-expenses-worksheet-luxury-tax-expense-for-schedule-c-expenses-spreadsheet.jpg

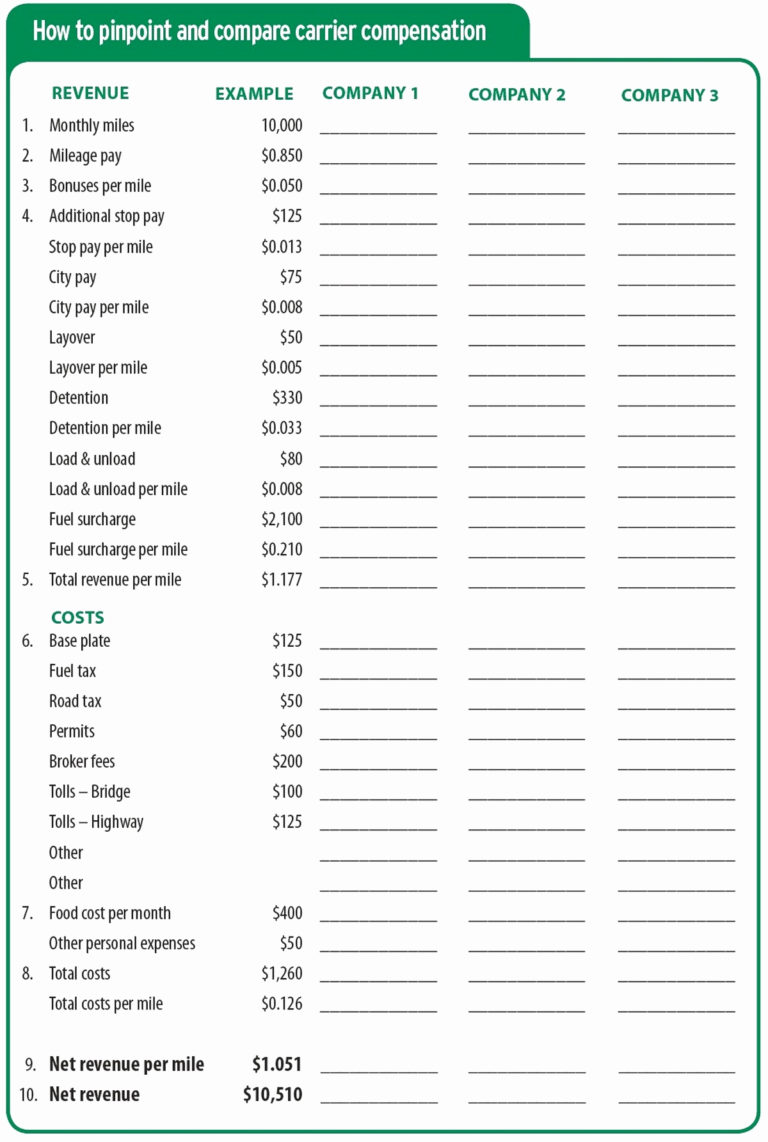

Truck Driver Expense Spreadsheet Db excel

https://db-excel.com/wp-content/uploads/2018/11/truck-driver-expense-sheet-unique-truck-driver-expense-spreadsheet-with-truck-driver-expense-spreadsheet-768x1142.jpg

Schedule C Income Tax Calculator

https://1044form.com/wp-content/uploads/2020/08/irs-schedule-c-instructions-step-by-step-including-c-ez-4.png

There are several areas on your tax return where you can claim your car and truck expense deduction Schedule A line 1 if you use your vehicle for medical purposes Schedule A line For information on how to report your car expenses that your employer didn t provide or reimburse you for such as when you pay for gas and maintenance for a car your em

Was vehicle used by a gt 5 owner or related person Do you have evidence to support the business use claimed Is it written evidence We are here to make your life less taxing Please ProSeries uses Asset Entry Worksheets to enter and track regular depreciation special depreciation bonus depreciation and Section 179 taken Each depreciable asset should be

Back To Trucking Expenses SpreadsheetRelated Posts Of Trucking

https://i.pinimg.com/originals/42/16/7a/42167abb490acf4d2acedef1f378a511.jpg

Car And Truck Do a Dots Dot Marker Pages For Toddlers And Preschoolers

https://i.pinimg.com/originals/89/c8/52/89c852b02d7bc09db47855871fe99aea.png

Irs Car And Truck Expenses Worksheet Instructions - Jan 24 2023 nbsp 0183 32 Car amp Truck Expenses Worksheet You should only be asked information regarding your business auto use if you indicated in the program that you use your auto for business