Income Tax Return Filing Date 2025 May 27 2025 nbsp 0183 32 Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Income tax Personal business corporation trust international and non resident income tax Feb 24 2025 nbsp 0183 32 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

Income Tax Return Filing Date 2025

Income Tax Return Filing Date 2025

https://static.wixstatic.com/media/f120be_b12578d534d5419dbf240502581c8b3f~mv2.png/v1/fill/w_980,h_747,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/f120be_b12578d534d5419dbf240502581c8b3f~mv2.png

Tax Return Filing Date 2025 Susana Martin

https://images.moneycontrol.com/static-mcnews/2022/12/ITR-filing-2712_001.jpg

Tax Return Filing Date 2025 Susana Martin

https://i.ytimg.com/vi/cZ-f0xO-DJc/maxresdefault.jpg

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year Jan 1 2025 nbsp 0183 32 Deducting tax from income not subject to CPP contributions or EI premiums We have built the tax credits for CPP contributions and EI premiums into the federal tax deductions

Jul 1 2025 nbsp 0183 32 The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

More picture related to Income Tax Return Filing Date 2025

Itr Filing Date 2025 Leah Peters

https://static.wixstatic.com/media/a64f72_d07e6b0e5f6a4fd9ab73f487ed58b899~mv2.jpeg/v1/fill/w_1000,h_563,al_c,q_85,usm_0.66_1.00_0.01/a64f72_d07e6b0e5f6a4fd9ab73f487ed58b899~mv2.jpeg

Tax Day 2025 Date Extension Zaina Claire

https://academy.tax4wealth.com/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

Irs Schedule B 2025 Free Christina R Wester

https://images.ctfassets.net/y88td1zx1ufe/RdGvHOCeLQJugUqRnOTbJ/3e682ed9b29f653132ec1a63656cafd9/Tax_filing_timeline.png

Jul 3 2025 nbsp 0183 32 Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services Mar 1 2024 nbsp 0183 32 How to work out how much tax you will pay on your bonus manually Step 1 Determine your taxable income for the year by multiplying your monthly salary by 12 Step 2

[desc-10] [desc-11]

Tax Deadline 2025 Los Angeles Catarina Martin

https://thecollegeinvestor.com/wp-content/uploads/2024/01/TCI_-_2024-TAX-REFUND-CALENDAR-Updated-1.png

2025 Income Tax Deadline Date Ashtons B Bailey

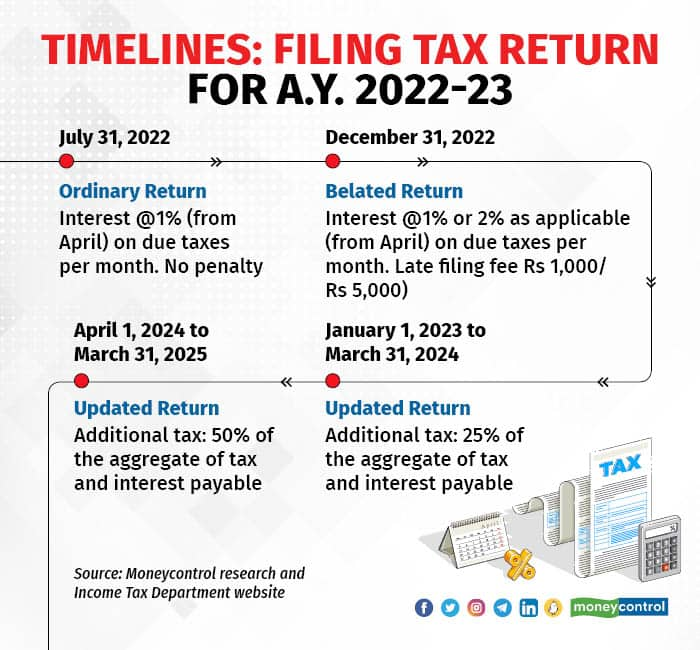

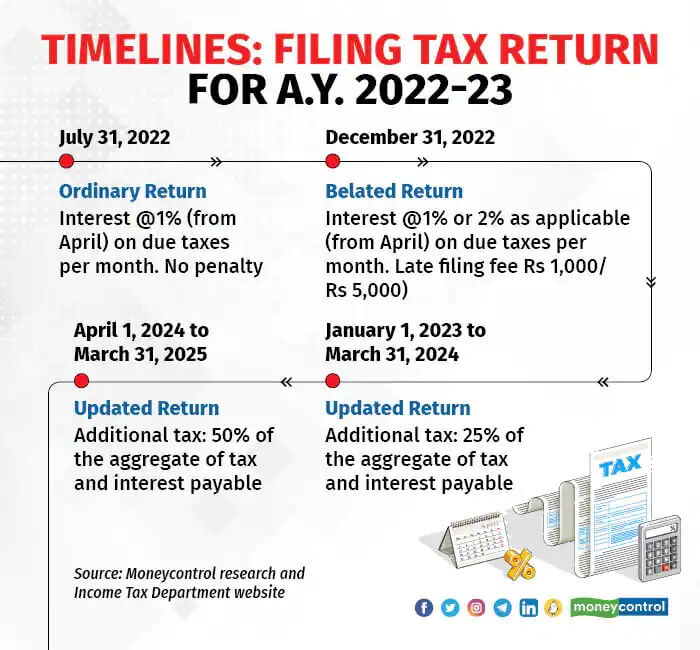

http://bemoneyaware.com/wp-content/uploads/2022/07/timelines-filing-tax-return.jpg

Income Tax Return Filing Date 2025 - [desc-13]