Income Tax Bracket Philippines 2024 Feb 24 2025 nbsp 0183 32 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

May 27 2025 nbsp 0183 32 Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full It s never been easier to do your taxes online In fact online filing gets you access to the benefits credits and refunds you may be eligible for even faster Last year approximately 93 of

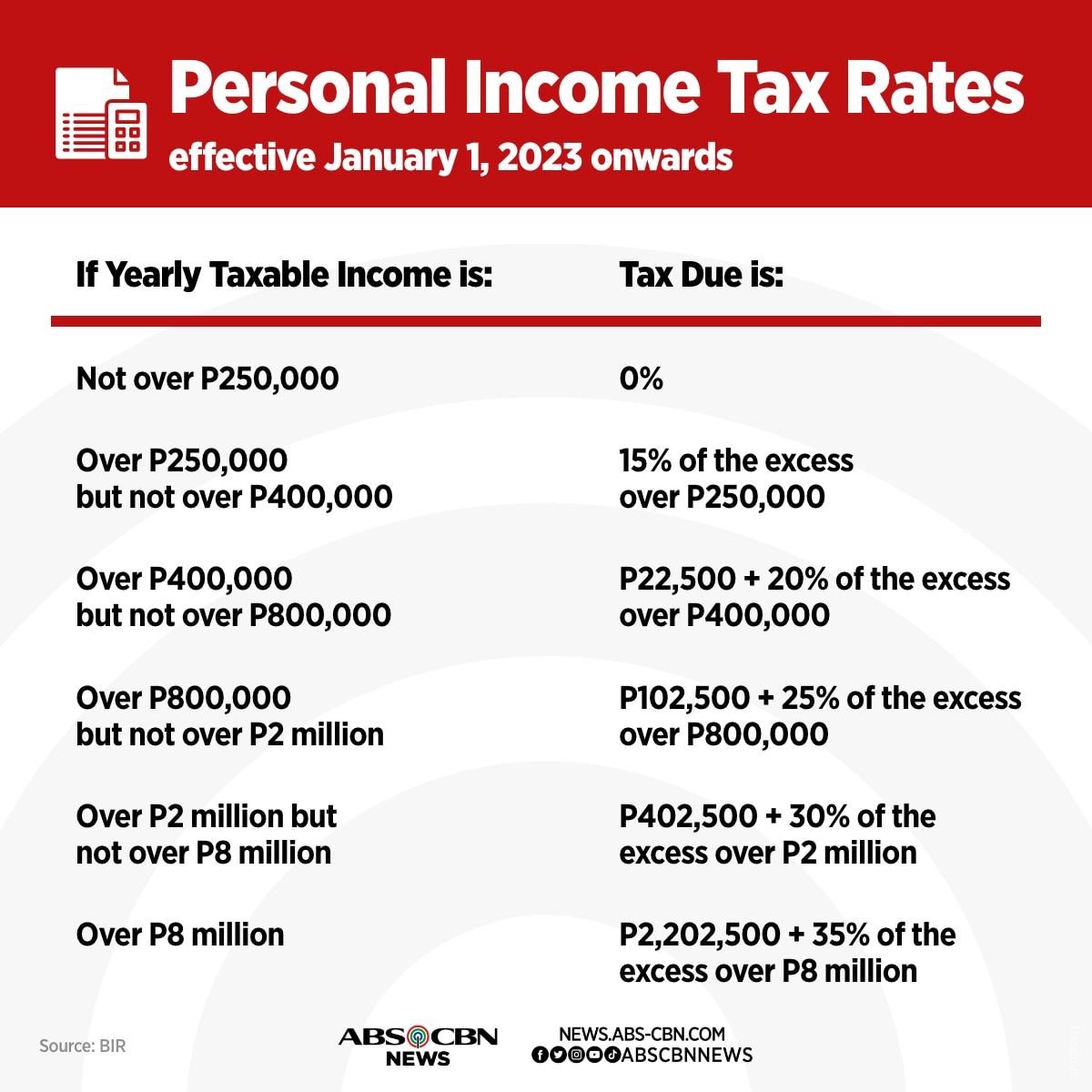

Income Tax Bracket Philippines 2024

Income Tax Bracket Philippines 2024

http://zico.group/wp-content/uploads/2018/06/Screenshot_5-1024x532.png

Income Tax Bracket Philippines 2024 Letta Claribel

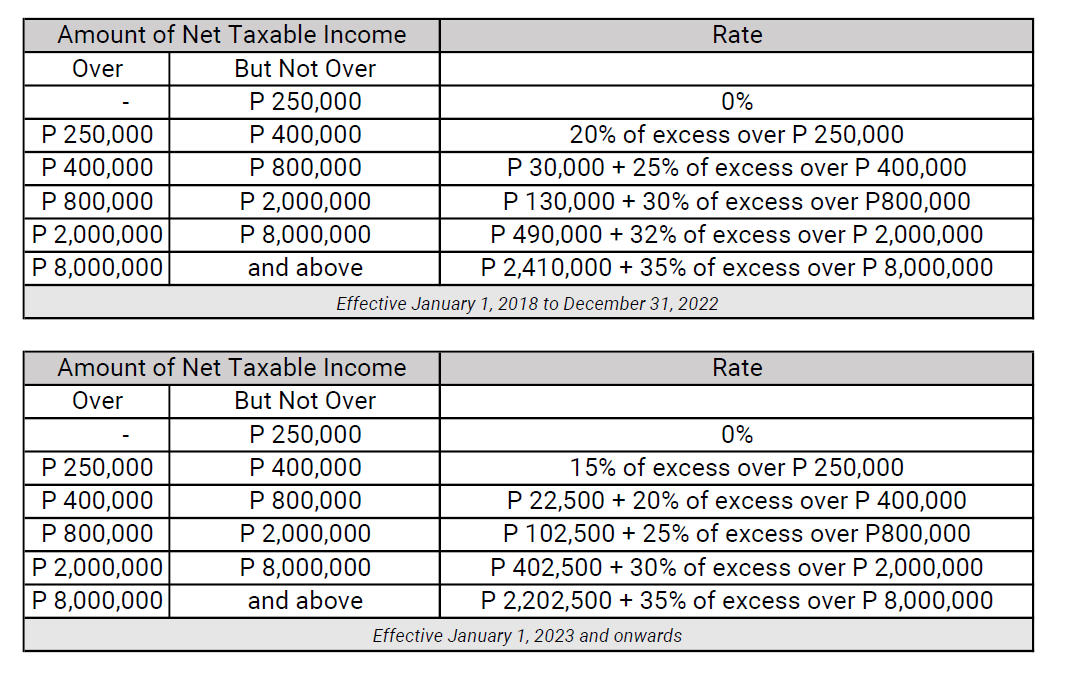

https://www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-tables-train-philippines-2018-2022.png

Income Tax Bracket Philippines 2024 Lise Sherie

http://business.inquirer.net/files/2016/08/tax-rates.jpg

The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide Jul 9 2025 nbsp 0183 32 NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

Apr 30 2025 nbsp 0183 32 Personal income tax How to file a tax return You may choose to do your own taxes or have someone else do them for you using tax software or on paper If eligible you may be What services are covered On this page Services covered How much will be covered Services covered The Canadian Dental Care Plan CDCP will help pay a portion of the cost for a wide

More picture related to Income Tax Bracket Philippines 2024

Tax Brackets 2024 Philippines Hestia Fredelia

https://taxcalculatorphilippines.com/images/bir-tax-table-for-tax-calculator-philippines.jpg

Tax Rate 2024 Philippines Bria Juliana

https://sa.kapamilya.com/absnews/abscbnnews/media/2022/life/12/28/2023-tax-rates.png

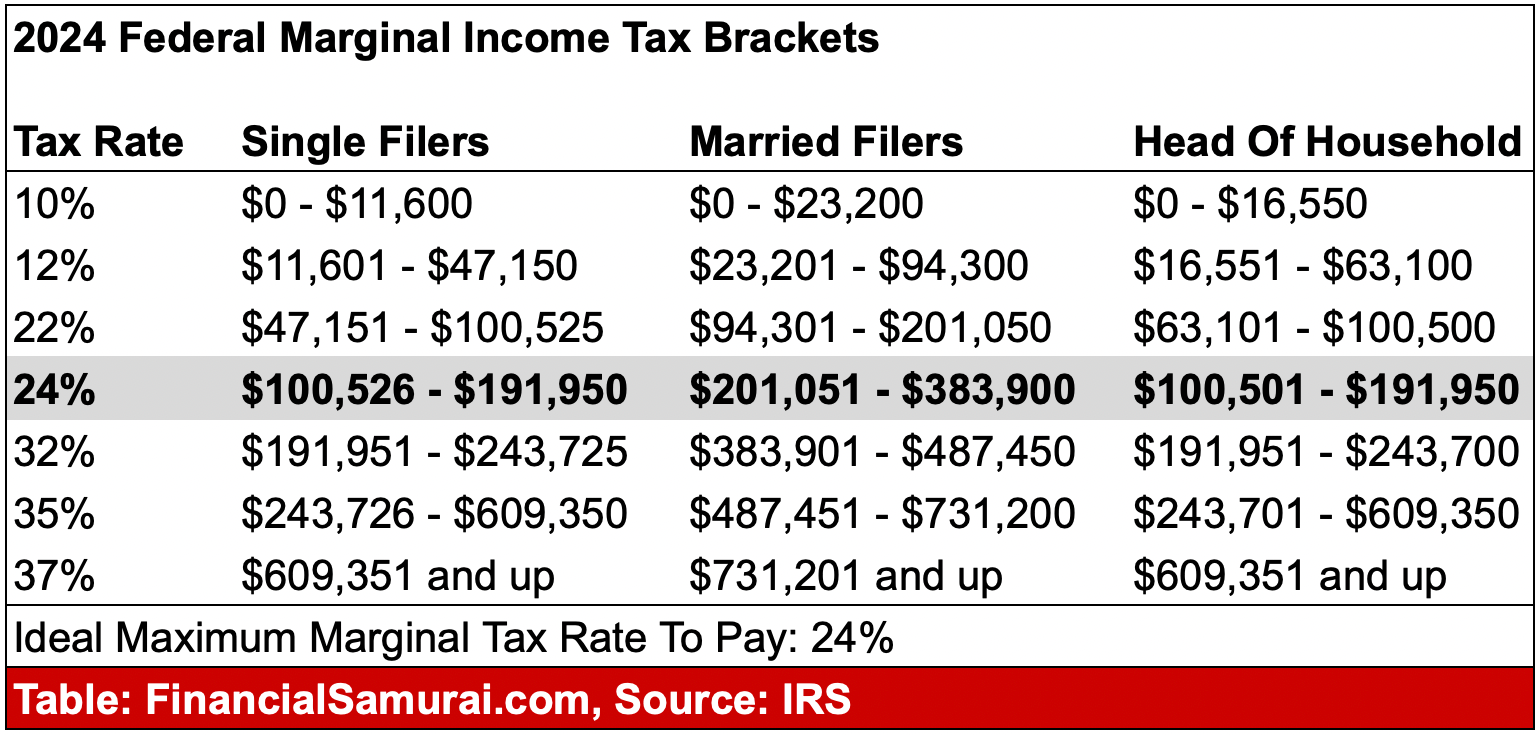

Tax Brackets 2024 Ally Lulita

https://moneywiseup.b-cdn.net/wp-content/uploads/2023/11/2024-fed-margina-income-tax-brackets.png

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was Jul 1 2025 nbsp 0183 32 The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax

[desc-10] [desc-11]

Personal Income Tax Philippines 2024 Rey Lenore

https://taxcalculatorphilippines.online/wp-content/uploads/2023/04/No-Tax-For-A-250000-Pesos-Annual-Taxable-Income.png

Tax Calculator 2025 Philippines Yuto Vanjonge

https://mpm.ph/wp-content/uploads/2023/08/image.png

Income Tax Bracket Philippines 2024 - [desc-13]