How To Calculate Student Loan Interest Deduction 2024 Jan 29 2025 nbsp 0183 32 The student loan interest deduction allows eligible taxpayers to reduce their taxable income by up to 2 500 based on interest paid on qualified student loans This deduction applies to loans taken out for higher education

How much can you deduct for student loan interest in 2024 See if you can qualify with our student loan interest tax deduction calculator Nov 7 2024 nbsp 0183 32 Here s how to estimate your future student loan payments To be eligible for the maximum student loan interest deduction of 2 500 for tax year 2024 your modified adjusted gross

How To Calculate Student Loan Interest Deduction 2024

How To Calculate Student Loan Interest Deduction 2024

https://i.ytimg.com/vi/FLxF6GJqlwE/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLDZ0x06nvE03sLIVf9PeRFffyyIgw

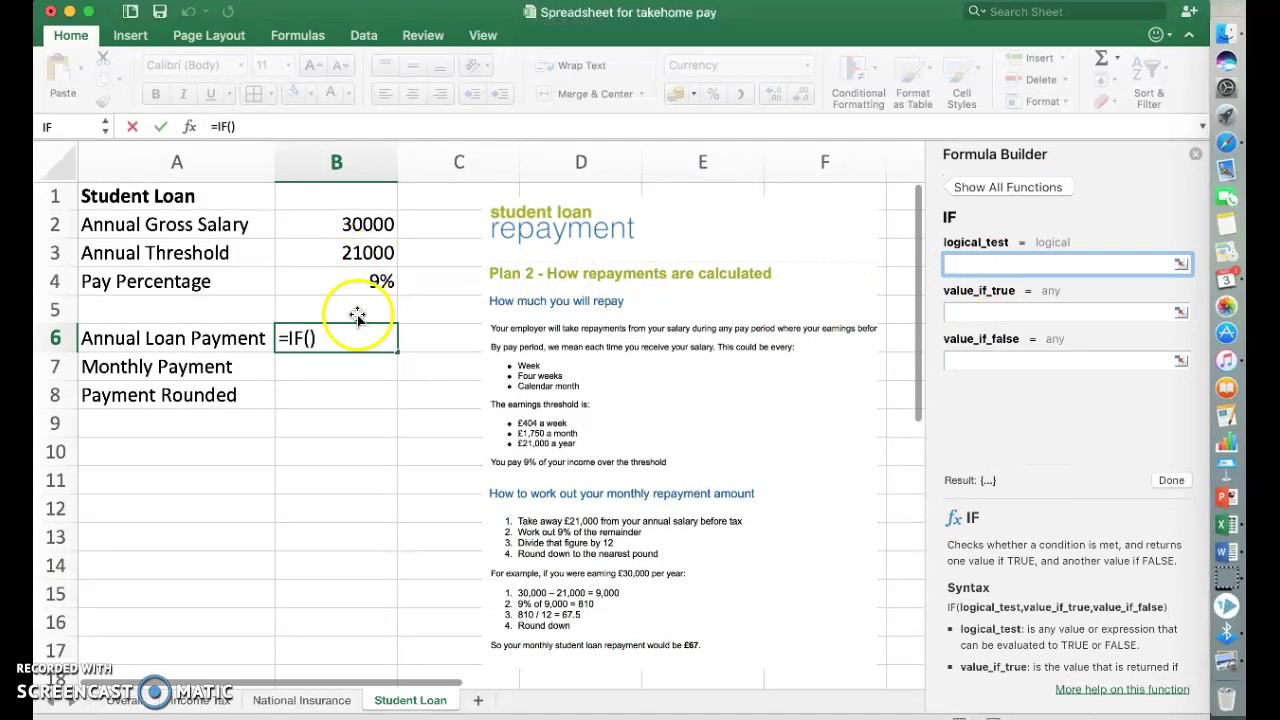

How To Calculate Student Loan Repayments YouTube

https://i.ytimg.com/vi/walbwwNT8qI/maxresdefault.jpg

Student Loan Interest Deduction Worksheet Walkthrough IRS Schedule 1

https://i.ytimg.com/vi/s0chvRztX1Q/maxresdefault.jpg

Jun 15 2024 nbsp 0183 32 Fortunately you can easily determine if your income falls in the phase out range using our handy student loan interest deduction phase out calculator Just input a few pieces of Jun 17 2024 nbsp 0183 32 How to calculate student loan interest deduction You don t need a student loan interest deduction calculator to figure out how much student loan interest you can deduct from your income tax Here s a step by step guide

Mar 28 2024 nbsp 0183 32 You can lower how much tax you pay by using a student loan interest deduction a form of loan to cover educational expenses This means the government lets you pay less tax Apr 6 2024 nbsp 0183 32 The 163 4 00 Student Loan deduction is calculated as follows Deduct the pay period threshold of 163 480 57 from the weekly earnings of 163 530 The excess is 163 49 43

More picture related to How To Calculate Student Loan Interest Deduction 2024

Loan Calculator For Student Loans Analyze Your Student Loans YouTube

https://i.ytimg.com/vi/T5JI1ofJuz4/maxresdefault.jpg

How To Calculate Your Student Loan Monthly Payment YouTube

https://i.ytimg.com/vi/_KRBqpnR0xs/maxresdefault.jpg

Student Loan Interest Deduction Worksheet Walkthrough IRS Publication

https://i.ytimg.com/vi/uexCffAylnM/maxresdefault.jpg

If you have qualified student loan interest you may be able to take a deduction for a portion of what you paid on your federal income tax return It may sound simple but the rules can make it complicated Jan 14 2025 nbsp 0183 32 The student loan interest tax deduction is a valuable tool for reducing your taxable income It allows you to deduct up to 2 500 of interest paid on qualified student loans

In fact federal student loan borrowers could qualify to deduct up to 2 500 of student loan interest per tax return per tax year As long as your student loan qualifies you can claim the student loan interest tax deduction as an Feb 9 2024 nbsp 0183 32 2 Calculate adjusted gross income AGI on Form 1040 3 Use the student loan interest deduction worksheet to find the MAGI specific deduction 4 Complete relevant

How To Calculate Student Loans Interest Rates And Monthly Payments

https://i.ytimg.com/vi/FjlkLGxtBHI/maxresdefault.jpg

How To Calculate Student Loan Interest With PMT Formula YouTube

https://i.ytimg.com/vi/HpENdFg3a0g/maxresdefault.jpg

How To Calculate Student Loan Interest Deduction 2024 - Apr 6 2024 nbsp 0183 32 The 163 4 00 Student Loan deduction is calculated as follows Deduct the pay period threshold of 163 480 57 from the weekly earnings of 163 530 The excess is 163 49 43