How Do I Calculate My Tax Deduction For Working From Home Jun 30 2022 nbsp 0183 32 How To Calculate the Home Office Deduction Home business owners can calculate their home office deduction in two ways the simplified option or actual expenses

Jun 30 2024 nbsp 0183 32 Work out your claim for work related expenses you incur as a result of work you do from home as an employee Our calculator takes between 5 and 20 minutes to use This calculator covers the 2013 14 to 2023 24 income years Use either the fixed rate method 67 cents or actual cost method to work out your deduction for work from home expenses May 3 2021 nbsp 0183 32 To determine your deduction simply multiply your office s total square footage by 5 The maximum amount you can claim using the simplified method is 1 500 300 square feet which can

How Do I Calculate My Tax Deduction For Working From Home

How Do I Calculate My Tax Deduction For Working From Home

https://i.ytimg.com/vi/s4Plrs_t-Rw/maxresdefault.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home Oct 16 2024 nbsp 0183 32 How do you calculate the home office deduction as a self employed person Calculating the home office deduction under the simplified method is straightforward You take the square footage of your home office used exclusively for your self employed business and multiply it by 5 per square foot up to a maximum of 1 500 per year

Oct 16 2024 nbsp 0183 32 If you work from home you need to know how to qualify for the home office deduction pay self employment taxes and understand which business expenses you can take deduct Jun 26 2021 nbsp 0183 32 You need to figure out the percentage of your home devoted to your business activities utilities repairs and depreciation Home Office Deduction Tax Topic 509 Business Use of Home Form 8829 PDF Publication 587

More picture related to How Do I Calculate My Tax Deduction For Working From Home

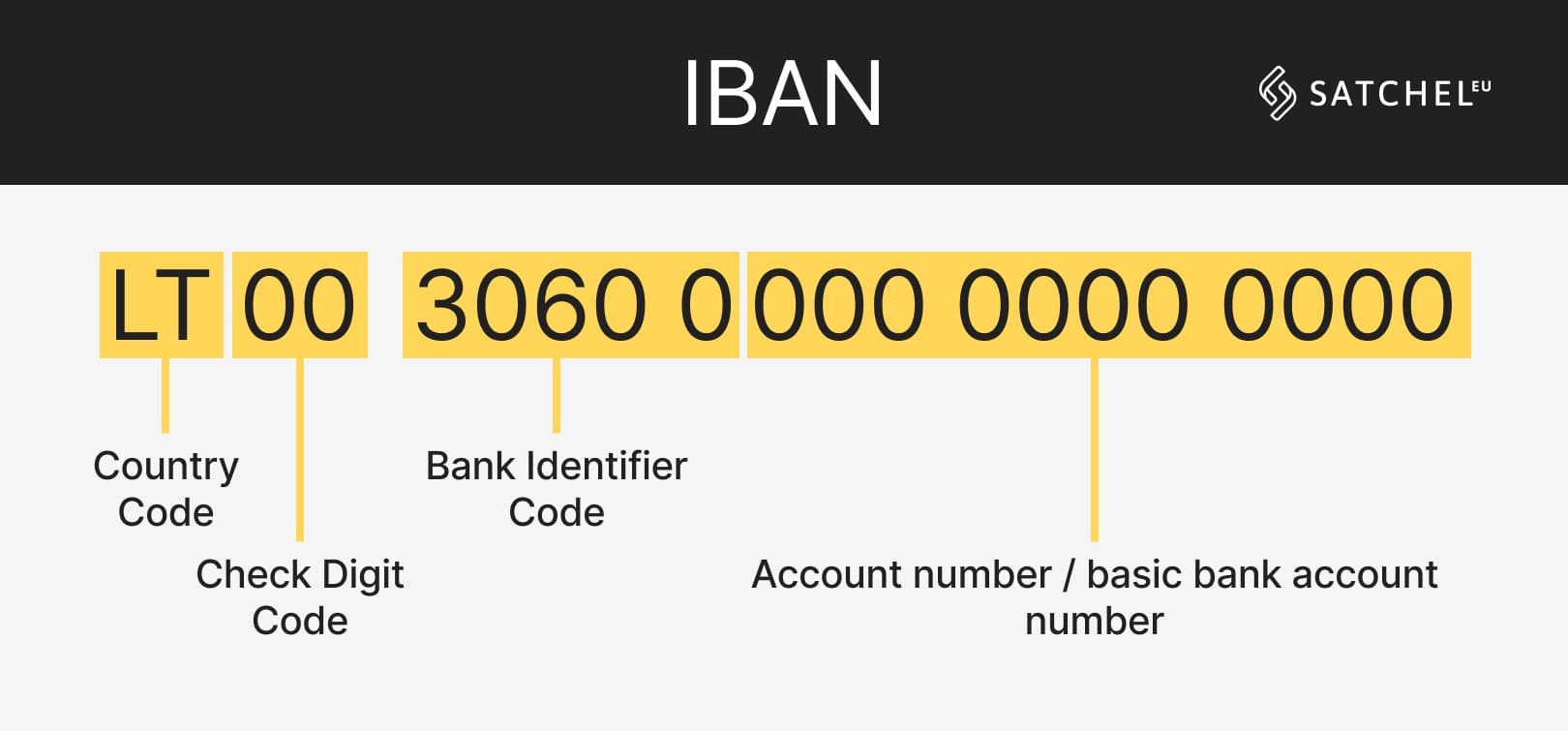

What Is My IBAN Number

https://satchel.eu/wp-content/uploads/2023/04/how-to-find-my-iban2-min.jpg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs Jun 3 2024 nbsp 0183 32 That is why it is so important to understand the tax rules for working remotely whether it is 100 of the time or just occasionally This article breaks down the key things you need to know about how remote work impacts your taxes from figuring out your residency status to understanding multi state tax obligations

Oct 29 2024 nbsp 0183 32 Rent or mortgage interest A portion of your rent or mortgage interest can be deducted based on the percentage of your home used for work Utilities Things like electricity heating and internet are also deductible Again it s only the percentage that applies to your home office Home repairs If you make repairs to the part of your home used as an office you can Apr 4 2024 nbsp 0183 32 Self employed people can generally deduct office expenses on Schedule C Form 1040 whether or not they work from home This write off covers office supplies postage computers

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

How Do I Calculate My Tax Deduction For Working From Home - Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home