Does California Have Personal Property Tax On Cars Aug 6 2024 nbsp 0183 32 While there isn t a separate personal property tax for vehicles in California the Vehicle License Fee fulfills a similar role It s important to note that this fee recurs annually

So you re sitting there cruising the Golden State in your sweet ride and you start wondering Do I have to pay property tax on my car in California Well buckle up buttercup because we re Jan 26 2022 nbsp 0183 32 When you re self employed and use your car in your business you re allowed to claim the business portion of your state and local personal property taxes on your motor

Does California Have Personal Property Tax On Cars

Does California Have Personal Property Tax On Cars

https://www.weekendlandlords.com/wp-content/uploads/2022/11/Vehicle-Property-Tax-Rates-by-State-Map-1280x802.png

Tony Katz And The Morning News 4 11 25 4 11 25 By 93 1 WIBC FM

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1096738058678282

LIVE President Trump Marks 100 Days In Office In Macomb County

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=995800178774607&get_thumbnail=1

The property tax on these vehicles is collected and distributed to local governments by the California Department of Motor Vehicles as a part of the vehicle registration process Aug 20 2023 nbsp 0183 32 If you re short on time here s a quick overview California levies a vehicle property tax at a rate of 1 of your car s assessed value each year collected with registration fees

Oct 15 2020 nbsp 0183 32 However the state has an effective vehicle tax rate of 2 6 according to a property tax report published earlier this year by WalletHub which calculated taxes on a 25 000 vehicle VA AND NC are the only states that have personal property taxes on vehicles Please don t try and justify the reasoning of paying sales tax on a vehicle every year by saying it s because VA

More picture related to Does California Have Personal Property Tax On Cars

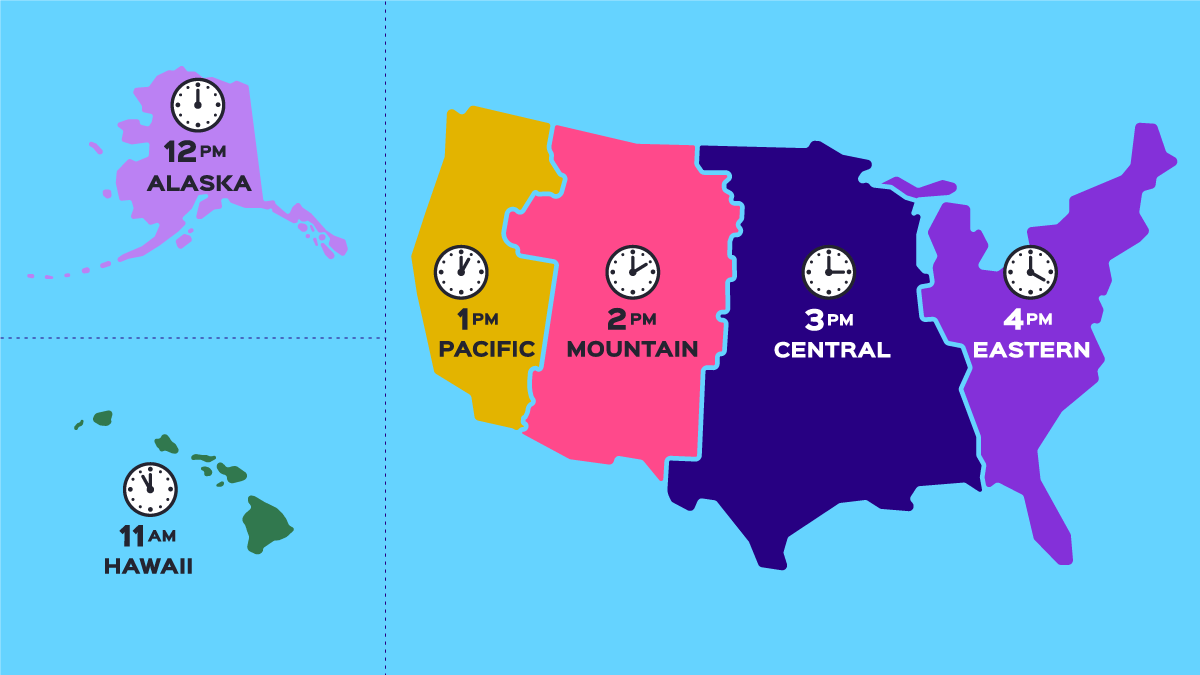

Is Pacific Time And Mountain Time The Same Hot Sale

https://smallbusiness.patriotsoftware.com/wp-content/uploads/2022/09/timezones.png

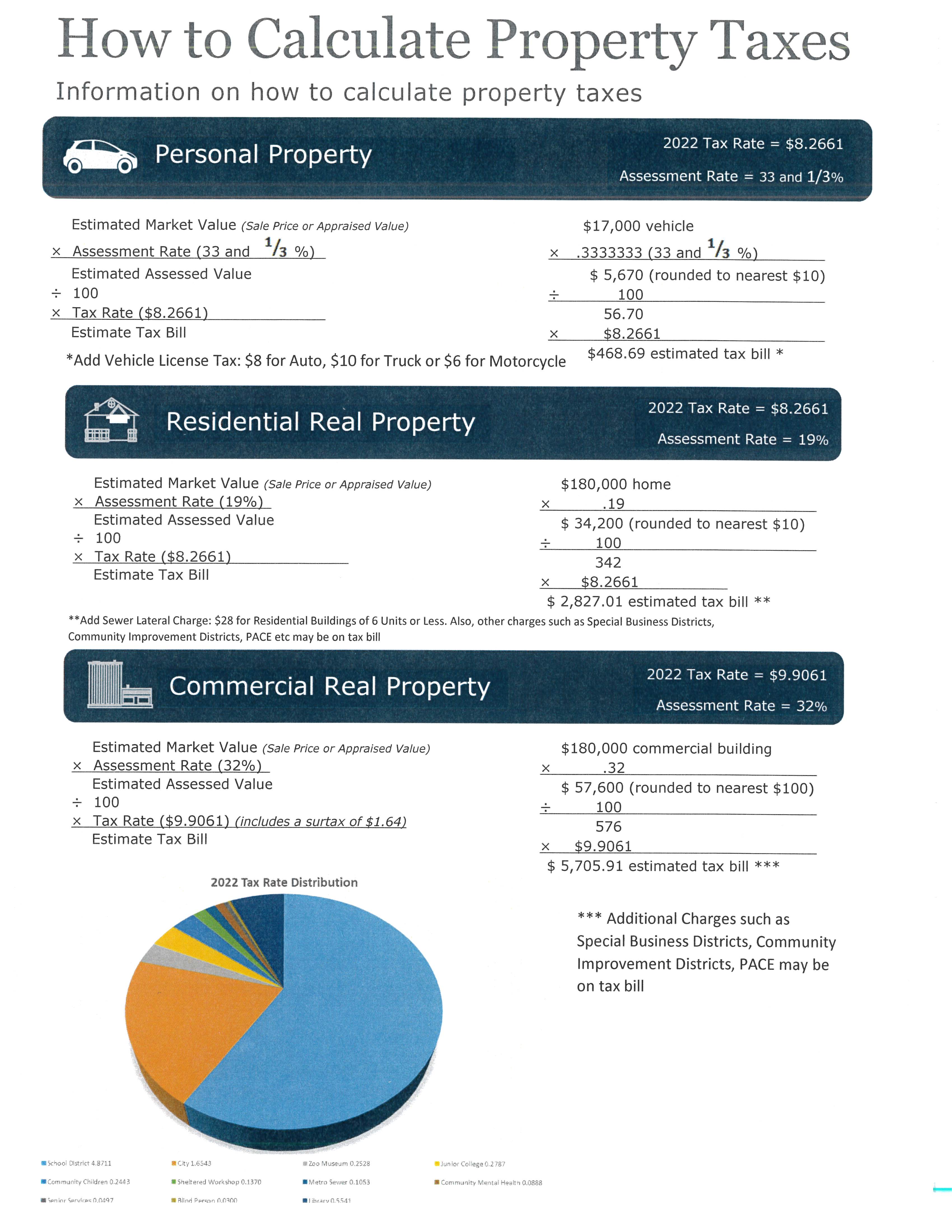

City Of Memphis Property Tax

https://www.stlouis-mo.gov/government/departments/assessor/real-estate/images/ASR-A-001-stlouis-mo.jpg

Parrot Habitat Map

https://ktla.com/wp-content/uploads/sites/4/2023/06/Red-masked-Parakeet-Luke-Tiller.jpg?strip=1

Texas California Florida and New York do NOT impose a personal property tax on vehicles whereas Connecticut Massachusetts Rhode Island New jersey doesnt have personal property on vehicles either Aug 29 2023 nbsp 0183 32 It exempts household goods vehicles and intangible assets from personal property taxation but it does assess a state personal property tax on certain types of business equipment

5 days ago nbsp 0183 32 When any part of the registration fee is based on the vehicle s value it is considered a personal property tax Even for those who don t have a business if they itemize their A This one s a little tricky because California doesn t have an annual property tax for cars Instead they have a Vehicle License Fee VLF which is like a personal property tax

Third Time In 2023 Honda Atlas Again Raises Car Prices By Up To Rs550

https://i.brecorder.com/primary/2023/02/17192428bee2e34.jpg

Property Tax St Louis 2025

https://propertytaxgov.com/wp-content/uploads/2022/09/st-louis-county-personal-property-taxes-receipt-1536x760.jpg

Does California Have Personal Property Tax On Cars - VA AND NC are the only states that have personal property taxes on vehicles Please don t try and justify the reasoning of paying sales tax on a vehicle every year by saying it s because VA