Business Use Of Home Worksheet Purpose of Form Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to 2024 of amounts not deductible in 2023 Use a separate Form 8829 for each home you used for the business during the year You must meet specific requirements to deduct expenses for the business use of your

How to use this home office deduction worksheet We built this worksheet in Google Docs so you can use it anywhere you want for free all you need is an internet connection But if you d like to download your copy and use it in Excel you can do that too The worksheet is split up into three parts Your Business Use Percentage Calculator 587 Business Use of Your Home and Pub 527 Residen tial Rental Property Exceptions The following situations of business or rental usage don t affect your gain or loss calculations Space within the living area If the space you used for business of rental purposes was within the living area of the home then your usage doesn t affect your

Business Use Of Home Worksheet

Business Use Of Home Worksheet

https://www.anchor-tax-service.com/s/cc_images/cache_2322187.jpg?t=1395581320

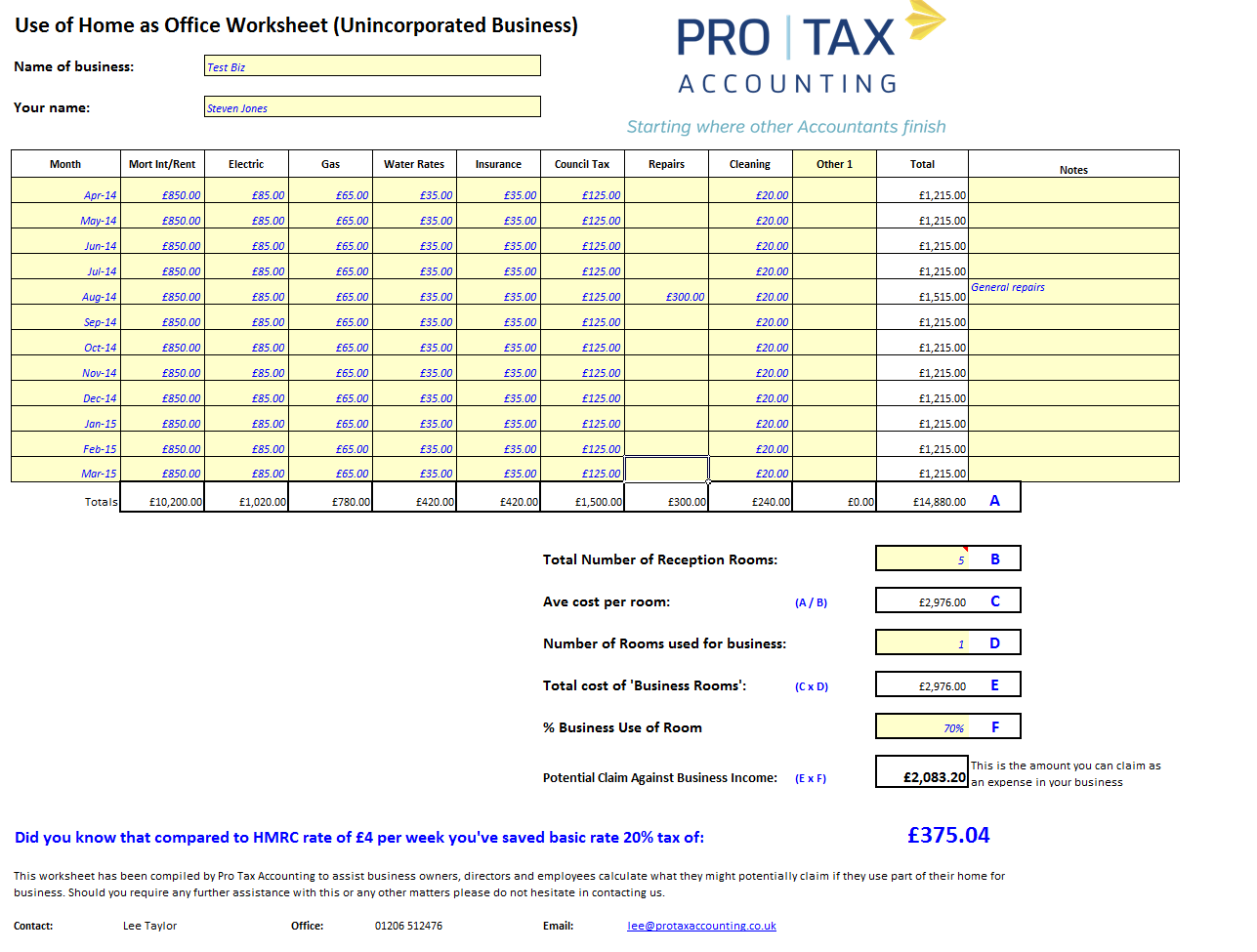

Use Of Home Worksheet For SE Pro Tax Accounting Accountant Colchester

https://www.protaxaccounting.co.uk/wp-content/uploads/2015/03/Use-of-home-Worksheet-for-SE.png

47 Real Estate Math Formulas Background Math Edu

http://db-excel.com/wp-content/uploads/2019/01/real-estate-math-formulas-spreadsheet-pertaining-to-50-best-of-real-estate-math-formulas-spreadsheet-documents-ideas.jpg

Simplified Home Office Deduction The simplified method as announced in Revenue Procedure 2013 13 is an easier way than the method provided in the Internal Revenue Code the standard method to determine the amount of expenses you can deduct for a qualified business use of a home The standard method has some calculation allocation and substantiation requirements that can be complex Using IRS Form 8829 Part I of Form 8829 You calculate the part of your home used for business For most businesses you simply divide the square footage used for your business by the total square footage of your house If you run a daycare facility in your home in an area that s not exclusively used for the business you ll have to make

Line 8 In Line 8 enter the amount from Schedule C Line 29 plus the following Add any gains derived from the business use of your home Subtract any loss from the trade or business not derived from the business use of your home If applicable these gains and losses might appear on either Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 or 1040 SR and any carryover to 2020 of amounts not deductible in 2019 You must meet specific requirements to deduct expenses for the business use of your home Even if you meet these requirements your deductible expenses may be limited

More picture related to Business Use Of Home Worksheet

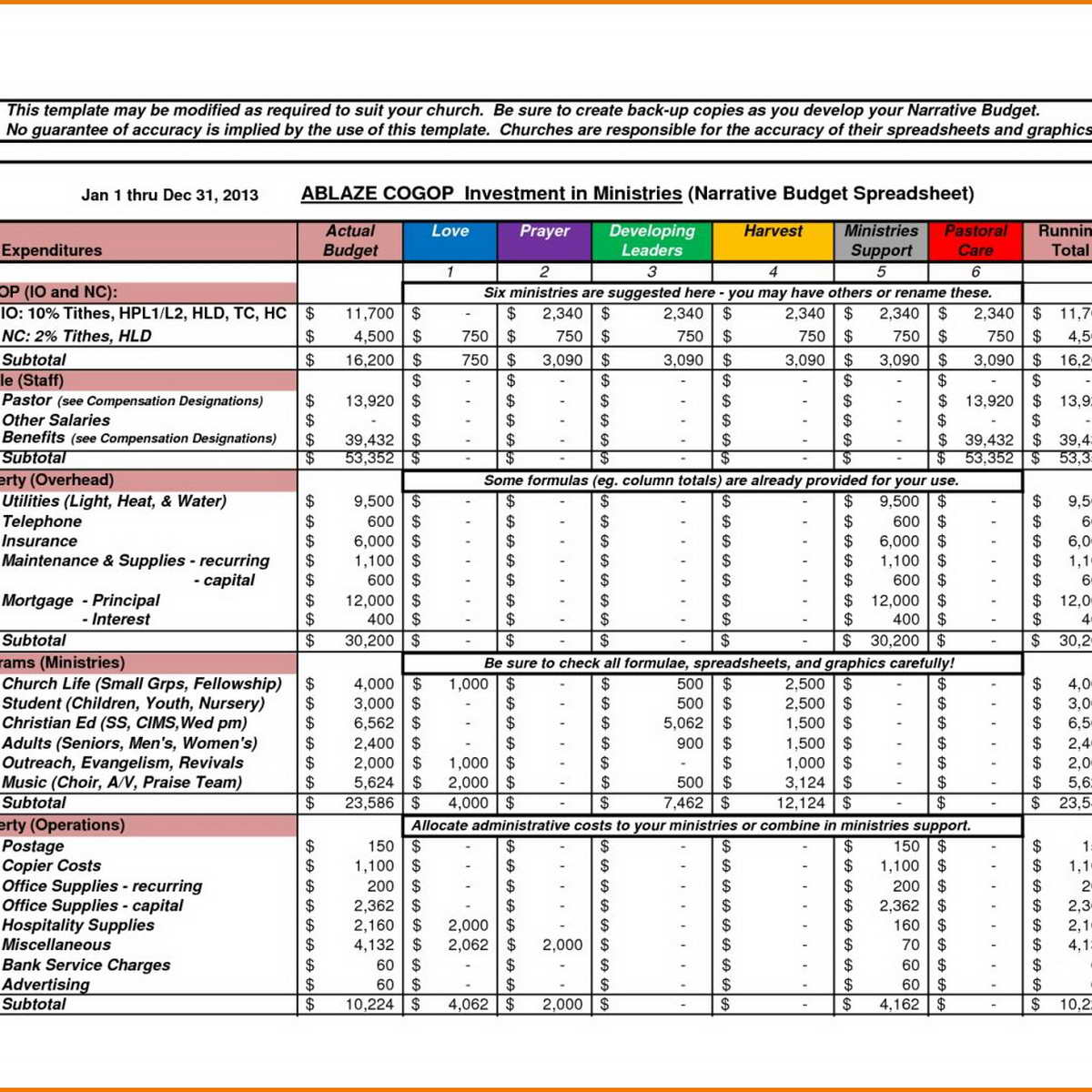

Business Budget Spreadsheet Inside Business Expense Spreadsheet

https://db-excel.com/wp-content/uploads/2019/01/business-budget-spreadsheet-inside-business-expense-spreadsheet-template-free-monthly-sheet-farm-travel.jpg

Deductions Worksheets Calculator

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/self-employed-tax-deductions-worksheet-2016.png

Printable State Tax Forms

https://www.pdffiller.com/preview/1/38/1038439/large.png

Cific area of your home for business on a regular basis In cidental or occasional business use is not regular use You must consider all facts and circumstances in determining whether your use is on a regular basis Trade or Business Use To qualify under the trade or business use test you must To calculate the simplified home office deduction you simply multiply the square footage of your home used for business by 5 per square foot As a result your maximum deduction amount is 15 000 The maximum square footage you can use is 300 square feet If your home office is larger than 300 square feet you have two options

In the farming business or a partner If you re in the farming business and file Schedule F Form 1040 Profit or Loss From Farming or a partner and you re using actual expenses use the Worksheet to Figure the Deduction for Business Use of Your Home to figure your deduction If you re using the simplified method to figure the deduction To view the Business Use of Home Worksheet when the business use of home is linked to anything other than the Sch C Go to the Fed Government Tab Select Worksheets Select Bus Use Home Note Form 8829 will be produced only if Interview Form M 15 is attach to a Schedule C If it is attached to any other entity Schedule A Schedule F or

:max_bytes(150000):strip_icc()/78005431-home-office-56a0a45a5f9b58eba4b25f12.jpg)

Simplified Home Office Deduction Option Explained Business Use Of

https://vedgeproducts.com/ef4a1de2/https/619dce/www.thebalancemoney.com/thmb/7Rgn-w8ZJTwSpIeC_iHWKhddutM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/78005431-home-office-56a0a45a5f9b58eba4b25f12.jpg

Business Use Of Home Worksheet Worksheet Crafter It Includes

https://i1.wp.com/s32508.pcdn.co/wp-content/uploads/2020/05/activity-sheet-costume-design-thumbnail.jpg

Business Use Of Home Worksheet - Business Use of Home Worksheet Instructions Use this form to help determine the business ratio to be used when computing business use of home SE HWS 1 BUSINESS USE OF HOME WORKSHEET CM 0017 15 33 09 NAME CASE DATE Method 1 Use for all businesses EXCEPT those licensed or exempt from licensing daycare businesses