Are Expenses Part Of Shareholders Equity Tuition fees for the course or program of studies living expenses for yourself and the family members who come with you while you re in Canada and transportation to and from Canada

Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to Detailed breakdown To claim attendant care expenses paid to a facility such as a retirement home you have to send us a detailed breakdown from the facility The breakdown must clearly

Are Expenses Part Of Shareholders Equity

Are Expenses Part Of Shareholders Equity

https://accountinguide.com/wp-content/uploads/2019/11/Income-Statement_v01.png

Fundamental Accounting Equation Problems And Solutions Diy Projects

https://study.com/cimages/videopreview/3_using_the_accounting_equation_adding_revenues_expenses__dividends_117356.jpg

Dominar Inmuebles S ntomas Share Premium Calculation Administrar

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/10/28215921/Paid-In-Capital.jpg

This page list authorized medical practitioners by province or territory for the purposes of claiming medical expenses at lines 33099 33199 Meal expenses If you choose the detailed method to calculate meal expenses you must keep your receipts and claim the actual amount that you spent If you choose the simplified method

Jan 31 2025 nbsp 0183 32 As a GST HST registrant you recover the GST HST paid or payable on your purchases and expenses related to your commercial activities by claiming input tax credits This page provides information about the General Index of Financial Information GIFI and how to use it

More picture related to Are Expenses Part Of Shareholders Equity

Example Financial Statements Accounting Play

http://accountingplay.com/wp-content/uploads/2015/08/L_4F_Income_statement_example.png

Statement Of Owners Equity

https://images.business.com/app/uploads/2022/03/23021829/shareholder-equity-3.png

Owners Equity Stockholders Equity Shareholders Equity Business

http://www.business-literacy.com/wp-content/uploads/2015/01/Balance-Sheet-629x1024.jpg

The National Joint Council Travel Directive provides for the reimbursement of reasonable expenses incurred while travelling on government business The directive is co developed by The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses

[desc-10] [desc-11]

Statement Of Shareholders Equity

https://innovatureinc.com/wp-content/uploads/2023/05/Wp-inmages-1.jpg

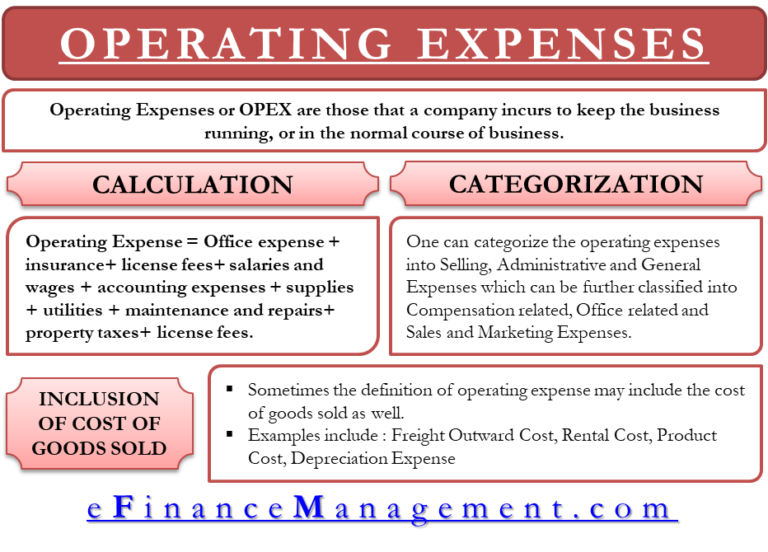

Operating Expenses Meaning Importance And More

https://efinancemanagement.com/wp-content/uploads/2019/08/Operating-Expenses-768x552.png

Are Expenses Part Of Shareholders Equity - Meal expenses If you choose the detailed method to calculate meal expenses you must keep your receipts and claim the actual amount that you spent If you choose the simplified method