457 Special Catch Up Rules Jan 3 2025 nbsp 0183 32 A 457 plan is a type of tax advantaged retirement plan offered primarily to state and local public employees and to some non profit employees It allows participants to defer a

Jan 17 2024 nbsp 0183 32 A 457 b is another type of deferred compensation plan that s available to public employees and those who work for certain tax exempt organizations It s similar to a 401 k Our 457 Plan Calculator is an easy to use online tool designed to help you estimate your future retirement savings based on your current age retirement age salary contribution rate current

457 Special Catch Up Rules

457 Special Catch Up Rules

https://i.ytimg.com/vi/lynrnjPA0kc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgWihjMA8=&rs=AOn4CLAYNlnvEKUv-Y2QElAJ7l2tCdFGVw

Contribute

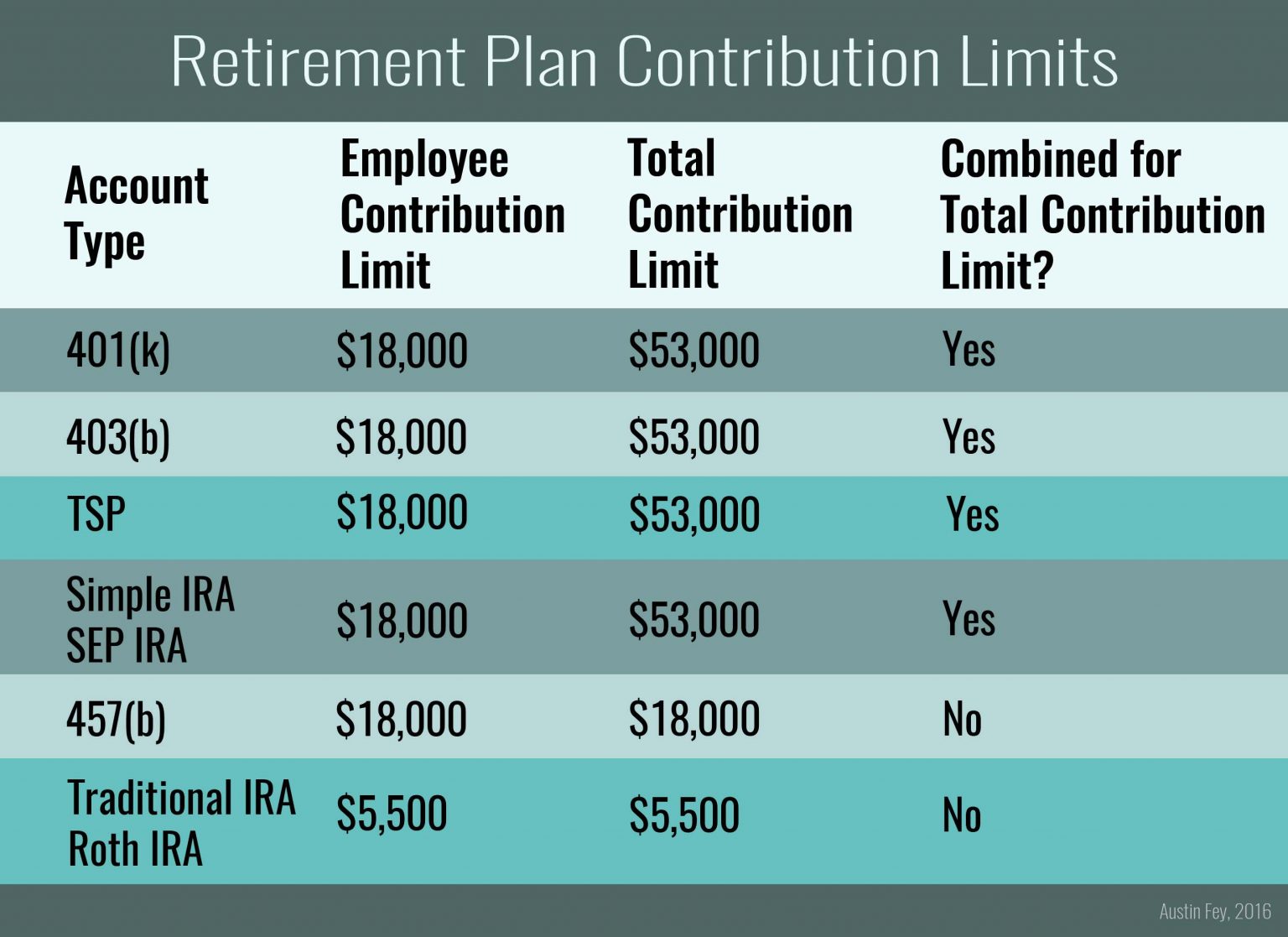

http://www.marottaonmoney.com/wp-content/uploads/2016/08/retirement-plan-contribution-limits-2016.jpg

Maximum Retirement Contribution 2025 Ulla Alexina

https://www.internetvibes.net/wp-content/uploads/2020/06/The-Best-Small-Business-Retirement-Plan-For-Your-Business-1536x1117.jpg

If you have a governmental 457 b and leave your job whether through retirement layoff or resignation you can begin taking distributions immediately without the 10 IRS early Dec 1 2024 nbsp 0183 32 A 457 plan is a deferred compensation plan primarily offered to government employees and non profit workers It allows you to set aside a portion of your salary for

Jan 16 2024 nbsp 0183 32 Learn about the 457 Plan its unique benefits for public sector and non profit employees and how it can be a crucial part of your retirement planning strategy What is a 457 b plan Learn how this deferred compensation plan helps public sector employees save for retirement 1 53

More picture related to 457 Special Catch Up Rules

IRA Contribution Discussions Andhrafriends

https://www.innovativecpagroup.com/wp-content/uploads/2022/12/2023-Retirement-Plans-Annual-Contribution-3-1024x1024.png

2025 Compensation Limits Elma French

https://eisneramperwmcb.com/wp-content/uploads/2021/11/chart1eisner-2048x776.jpg

2024 Compensation Limit Brandi Estrella

https://eisneramperwmcb.com/wp-content/uploads/2021/11/chart1eisner.jpg

Jun 22 2025 nbsp 0183 32 Learn how a Section 457 deferred compensation plan works for public employees and how the specific plan type determines your savings and access options Feb 11 2025 nbsp 0183 32 Learn about penalty free withdrawal options from 457 plans including eligibility criteria and distribution methods for both governmental and non governmental plans

[desc-10] [desc-11]

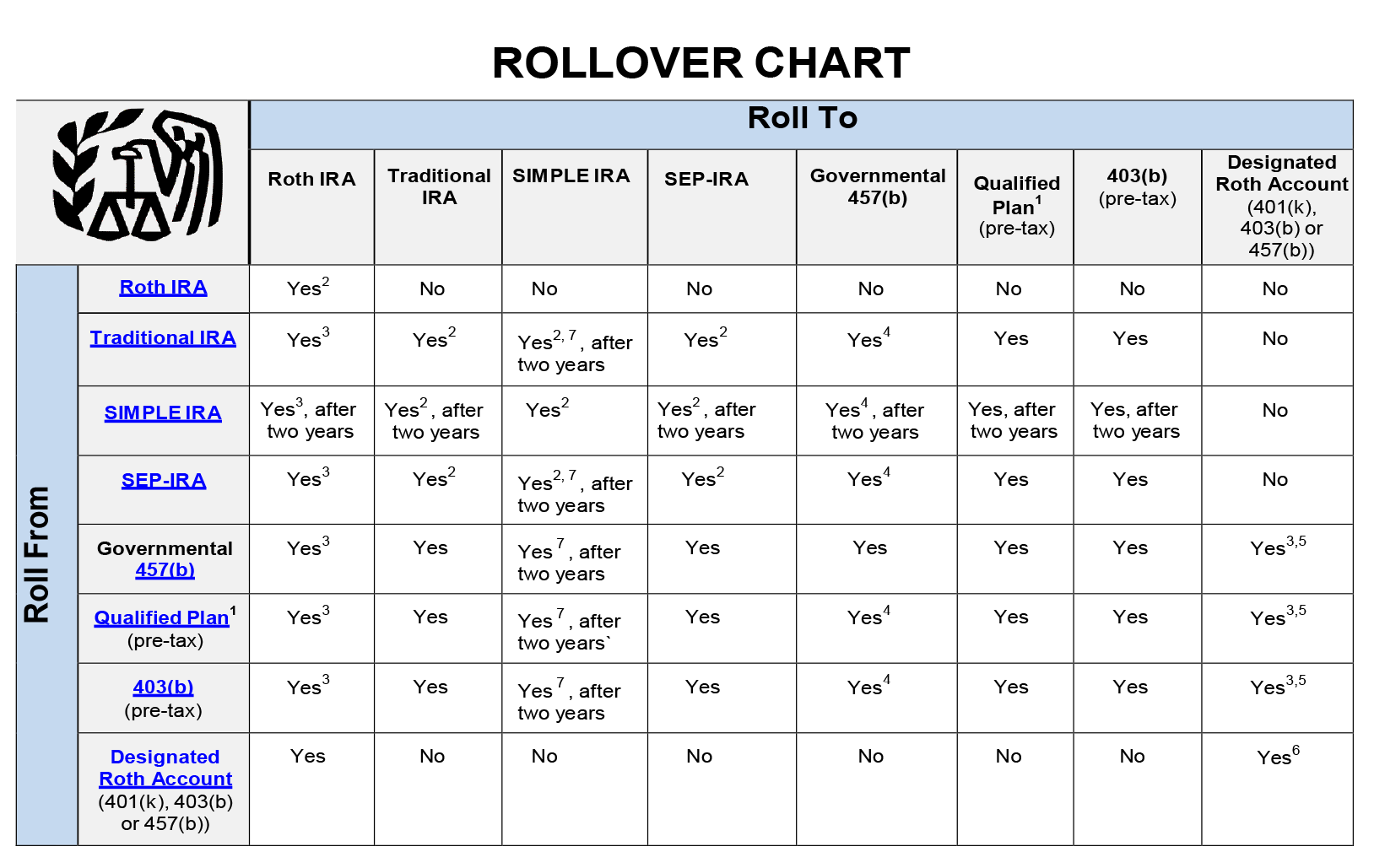

Roth 401k Rollover

https://www.nbsbenefits.com/wp-content/uploads/2019/04/Rollchart.png

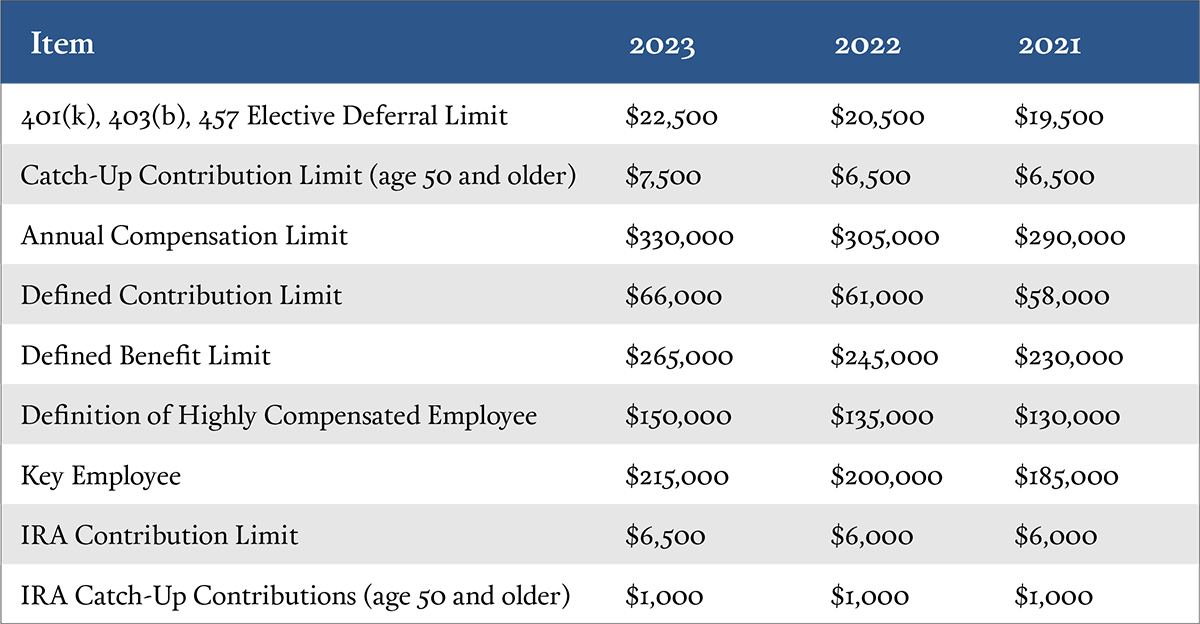

IRS Limits 2023 Archives Aegis Retirement Aegis Retirement

https://aegisretire.com/wp-content/uploads/2022/10/AegisRetirement-Chart-1200.png

457 Special Catch Up Rules - [desc-13]